The Three Year Itch, The Second Scale

If you are a startup that has survived for three years, have a substantial gross revenue, are EBITDA positive, are GAAP earnings profitable, and have an attractive annual growth rate — CONGRATULATIONS.

You are a top 1-5% startup company and now you face the Three Year Itch or the Second Scale issue.

The problem is this —

1. You are as busy as a one legged man in an ass kicking contest. Everybody is working their butt off. You can feel the effort in the air. Taste it. You are proud, but exhausted.

2. Noting the above, you feel the need to add hands and person hours to the organization — maybe, just to relieve the perceived burden currently. Belay that thought.

In your exhaustion, you are struggling to figure out how. Perfectly normal, sorry.

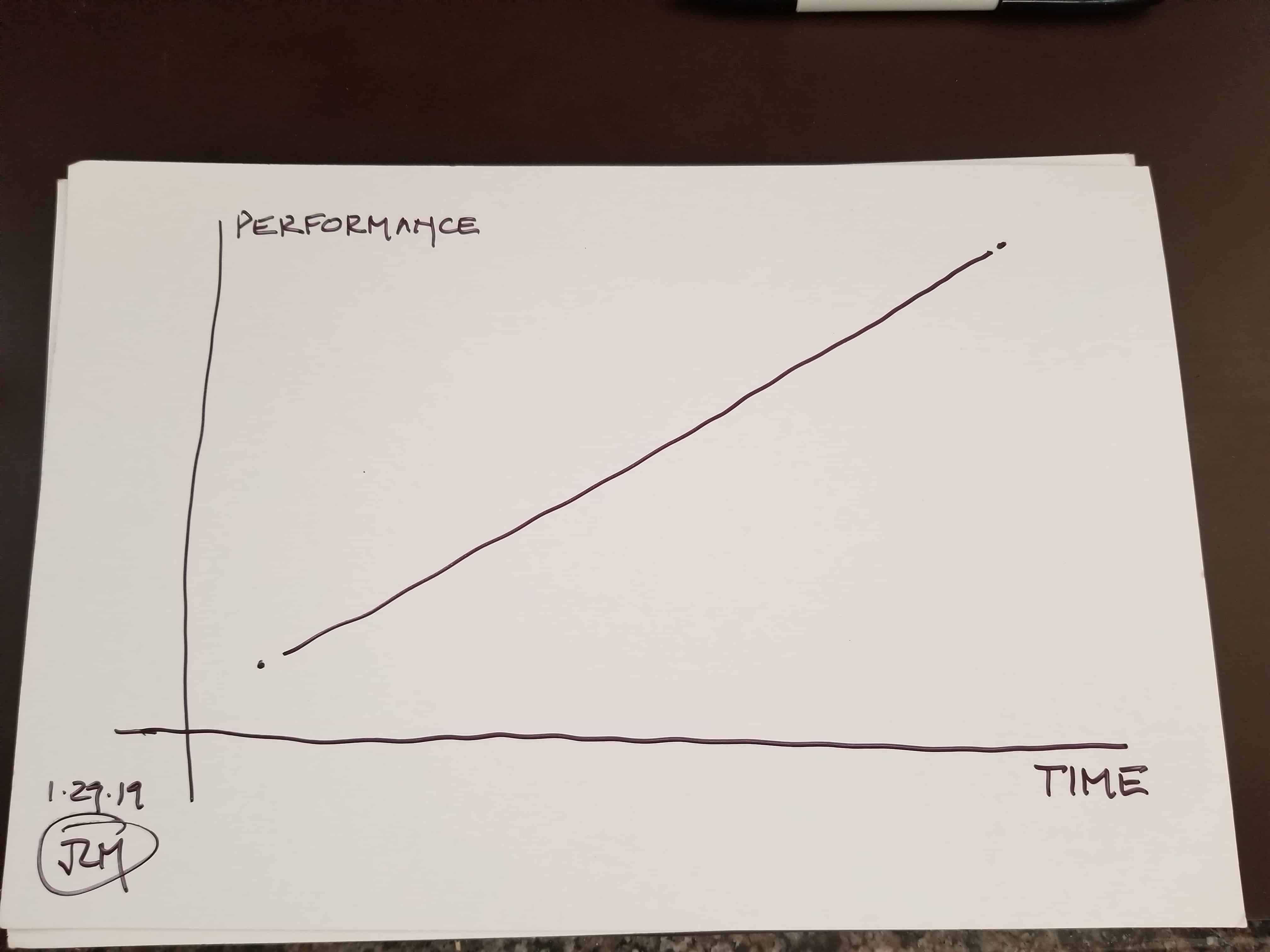

3. You want to grow — double in sales in the next 2-3 years [in my mind, you are in the $10MM range headed to $25MM in Year 3 of the New Plan (meaning Year 6 from founding)].

4. You are clearly a powerful entrepreneur, but you have no idea how to handle the next three years — you had no idea how to form a company and take it to market, but you seem to have knocked it out of the park, so do not fret.

5. You are going to do this thing. Why not do it under control? Continue reading