Guy I know says to me, “America was never energy independent, Big Red Car. It’s all just a myth. Fake news.” His chin is out, his face is slightly red, and his tone is provocative. In spite of all of that, I can detect he doesn’t quite believe his own malarkey.

“Really?” says I. “American energy independence is just a myth?”

He is a good friend, but taken to embracing leftist thoughts and believes I am a right wing radical myself. But, we have been friends for a long time, so we always resist the temptation to cancel each other.

“Yep. There is no proof,” says my amigo. Now, he looks quite pleased with himself. Takes a sip of his coffee and waits for me to respond. Meanwhile I am thinking through my response, committed to making it short, evidence-based, and conclusive.

“What if I could show you unequivocally that the US had massive crude oil production under the former regime and that it has diminished dramatically under the current regime?”

He laughed. It was a bitter laugh and didn’t befit him.

“Take your best shot,” he says and I do.

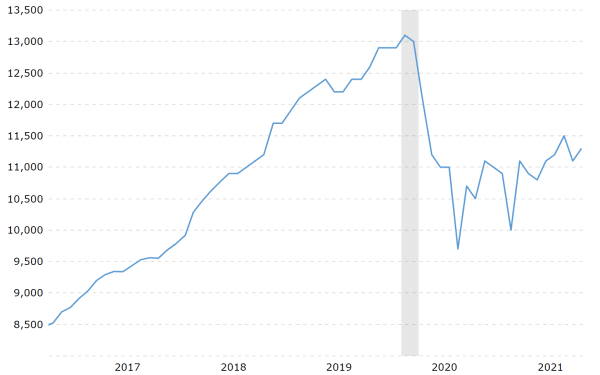

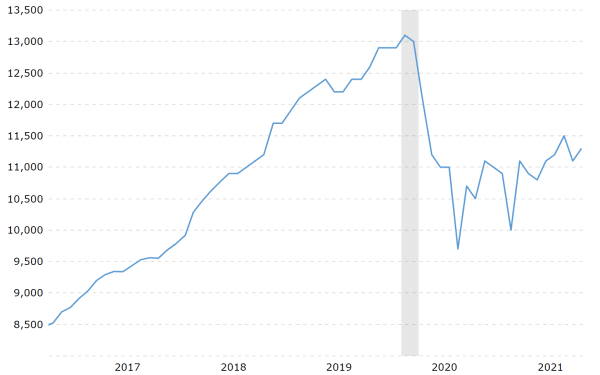

So, I showed him this graph:

The graph depicts American crude oil production in thousands of barrels per day over the time period of 2016 to today. It comes from a site called macrtotrends.net. Continue reading →