Today the Securities and Exchange Commission proposed a marriage of their oversight and a squirming, virginal reluctant bride — the Venture Capital industry.

Clearly, this is a shotgun marriage and there will be no honeymoon. The VC industry will protest it is rape, but you decide.

“Shots fired!”

As Ronald Reagan said, “The top nine most terrifying words in the English Language are: I’m from the government, and I’m here to help.”

Where I say the words “VC” or “venture capital” you may also read in private equity and any other adviser directed fund.

The Venture Capital Industry

Venture Capital is a private investment operation, as a general prospect. Private investors and private investment are regulated differently – some no regulation at all — than public companies.

The SEC regulates both of them.

VCs, however, solicit funds from entities with “public” funds and all of them are from funds that are fiduciaries for others. As an example, a pension fund for teachers may allocate some small chunk of its assets to venture capital through a VC. In effect, the VC is the pension funds adviser acting through a fund raised from similar investors.

The reason this is important to know is that these teachers — the ultimate beneficiaries and the real source of the money — are amongst the type of unsophisticated investors the SEC specifically exists to protect.

Almost without exception, VCs are investing OPM – other people’s money.

1. Total invested in 2021 — $681,000,000,000; 2022 — $445,000,000,000.

2. Total market — $16,000,000,000,000!

A quick word of caution – numbers on the VC market are notoriously unreliable because all of the numbers are private. Just be a little skeptical, but the sheer magnitude is not in doubt.

3. Deals closed in 2021 — 15,855, by approximately 1,000 active VC firms

4. Here is what the list of VCs prepared by the Sovereign Wealth Fund Institute as of December 17, 2022, based on assets under management, looks like:

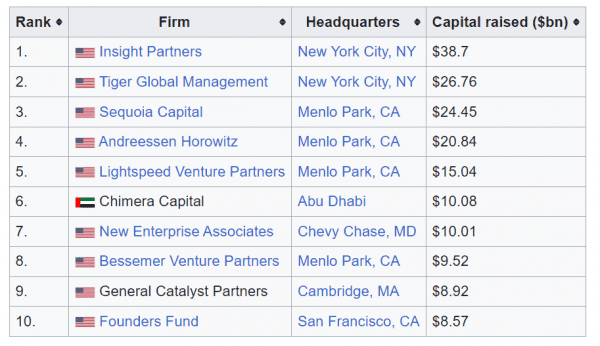

5. Here are the top VC fundraisers in the last 5 years from the Venture Capital Journal 2022:

Venture Capital is a damn big business and big businesses are always regulated by the government as they engage in interstate commerce.

Why now, Big Red Car?

Ahhh, excellent question. Here are the reasons this has happened now:

1. Sheer bigness – this is big business as noted above and big businesses get regulated under the Commerce Clause of the Constitution which means the Feds.

2. VC has gotten sloppy and has publicly spoken of their failure to conduct what the SEC would consider to be garden variety due diligence.

Nobody gets punished for failing to conduct adequate due diligence on a new investment. There is zero accountability.

3. There have been some colossal failures in VC.

The bell cow in that parade would be the recent flop sweat, bullet in the brain failure of FTX and its subsequent bankruptcy which has provided a horror story of massive investment, zero due diligence, horrific governance and failure to insist upon journeyman like governance by the investors, corruption, political involvement (largest Biden contributor was the founder of FTX), and corruption on a scale unseen before.

Would you give this 30-year old MIT grad $2,000,000,000 with zero due diligence? Take a minute to consider it. The founder of FTX: Sham Bankman-Fraud

Sequoia Capital lost more than $250,000,000 while a Canadian teachers’ fund lost $95,000,000. The lack of due diligence on this one investment may have been the straw that broke the camel’s back. It was egregious and there will be a slew of lawsuits over this.

Celebrity spokespersons Tom Brady and Gisele Bundchen lost $45,000,000, much of which was stock give to them for their spokesperson duties.

Hmmm, I wonder if Gisele divorced Tom because of this failed investment?

4. The SEC and the VC crypto boys have been fighting for years over whether Lite beer is great tasting or less filling — meaning whether crypto and tokens are securities and thus under the regulation of the SEC.

You cannot issue securities in the US without conforming to the rules of the Securities and Exchange Commission. The SEC has won virtually all of these enforcement actions.

The VC industry has brought this on themselves, gradually and then quickly.

5. Some of the biggest VCs held securities in their portfolio which forced them to register as Registered Investment Advisers who are regulated by the SEC.

If you put your head in the noose, somebody is going to pull it tight.

If you become an RIA, you are under the regulation of the SEC.

6. VCs and PE operators are in many instances larger than life and take positions publicly on many things — including VC — that are broad and have caught attention.

When you are loud, flamboyant, rich, politically antagonistic to those in power, and public you invite inspection.

So, what’s the deal, Big Red Car?

The deal is this (from an SEC press release):

The Securities and Exchange Commission today voted to propose new rules and amendments under the Investment Advisers Act of 1940 (Advisers Act) to enhance the regulation of private fund advisers and to protect private fund investors by increasing transparency, competition, and efficiency in the $18-trillion marketplace.

Hello, America, $18,000,000,000,000 marketplace, ahoy!

Here are some specifics:

1. The amended rules would require VCs to provide quarterly reports to investors (the people who give money to the VCs) on fees, expenses, and performance. This would also include specific investments and assets under management.

You will recognize this as being what every mutual fund manager is currently required to do.

VCs are notoriously secretive as to investments and performance. Several years ago when public investors (pension funds) desired to receive reports to provide to their beneficiaries, there was a major shit storm over the public release of what the VCs considered confidential information.

2. The SEC proposes to abolish and prohibit all preferential treatment of any kind unless it is disclosed to current and prospective investors.

The VC business is rife with “bespoke” structures as a means of attracting investment. In addition, every investment made by a VC contemplates some preferential treatment, some as innocent as receiving preferred stock rather than common stock.

[I cannot imagine this will apply to preferred stock, though some commentary indicates this is the case.]

3. The SEC would subject VCs to fund audits, certain specified books and records requirements, and restrictions on adviser-led secondary transactions.

This is very tame stuff for public companies and garden variety Delaware Corporation Law Sec 220 requests to inspect books and records are a bloody yawn, but VCs will squeal like a wolf with his paw in a sharp-edged, steel trap.

The VCs will not consider this a yawn. The “intrusion” of audits will be a game changer.

4. The SEC would prohibit the following:

a. seeking reimbursement, indemnification, exculpation, or limitation of liability for certain activities;

b. charging certain fees and expenses to a private fund or its own portfolio companies;

c. charging fees for unperformed services and fees related to the investigation or examination of the VC/adviser itself;

d. charging fees or expenses related to a portfolio investment on a non-pro rata basis;

e. borrowing or receiving an extension of credit (loan) from a private fund client; and,

f. reducing the amount of an adviser/VC clawback by the amount of certain taxes paid.

The above are taken directly from the SEC’s utterances and some are exact quotes.

5. VCs will be required to document their compliance with these new requirements by written testimonial as to their implementation through specific policies and procedures.

What happens next, Big Red Car?

What does not happen next is the VC industry rolls over and plays dead.

The public has 60 days in which to make public written comment on these new proposed amendments to the Investment Advisors Act of 1940.

The SEC will answer some or all of those comments, and may make some modification.

The rules will then be printed in the Federal Register prior to adoption. Ninety days later, they are the real McCoy.

Bottom line it, Big Red Car

The Securities and Exchange Commission is going to crack down on venture capital. It is long overdue.

This is a nine inning game, but the SEC has chalked up 17 runs for itself before the first pitch is thrown and it will be an uphill battle for the VC industry to overcome these requirements when they are exactly what other financial fiduciaries are subject to currently.

Look for the VCs to try to throw the ball over to the US Congress, but given the donation shenanigans of FTX and Sham Bankman-Fraud, this will be a whiff.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car.