Tech City Rent As A Measure Of Inflation

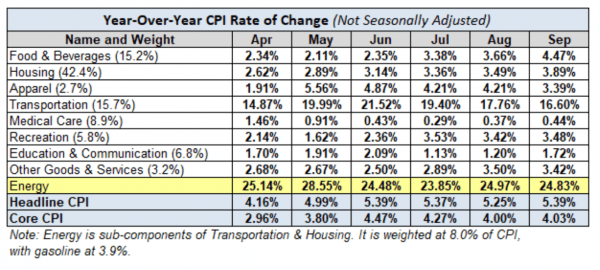

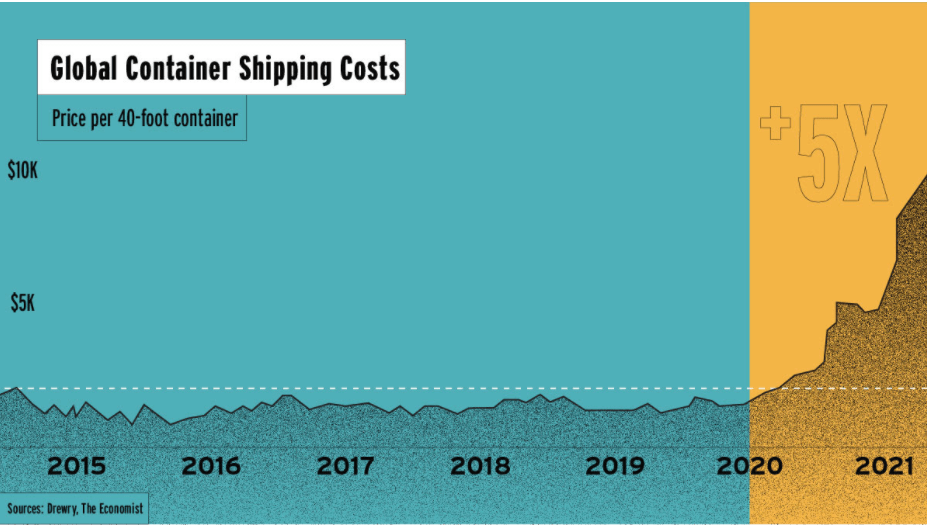

I am a little fixated on inflation these days. I look at modestly obscure sources of data to try to track the old bitch so when I read an article on average apartment rents in tech city markets, I had to bring it to your attention.

Let me cut to the chase.

1. Rents went down a little during the pandemic. The general sense is that rents went down about 5% nationwide.

2. With the advent of the vaccine, rents began to turn around and climb upward as folks began to return to offices and the migration to tech meccas resurged, and folks began to quit jobs to get better jobs (and better apartments).

Rents are up 25% in Austin By God Texas. Hello, America, can you say INFLATION?