One of the unique concepts of the Asian mind is the idea of “face.” It is a stew with reputation, honor, social standing, wealth, power, dignity, moral character, and integrity being the main ingredients.

One may give face, lose face, or save face and the Chinese have been focused on face for more than 5,000 years. The rest of the world is not so fixated on face.

Why do we care about face, Big Red Car?

Because, dear reader, we are dealing with the Chinese in regard to tariffs and non-tariff barriers to trade and face is a big deal with the Chinese.

The Chinese and the Americans — now having put the issue in the middle of the table and feeling the first impacts of the tariffs — desperately want to arrive at some compromise.

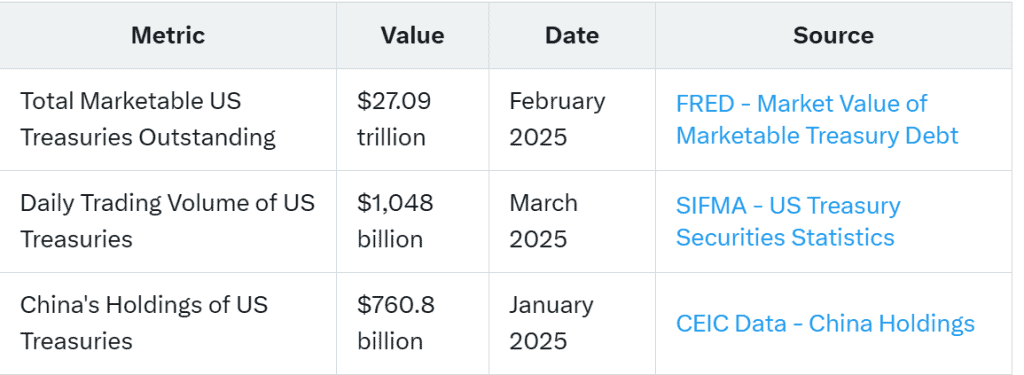

1. The Americans — meaning President Trump — are more than willing to enter into discussions and already have. The Trump admin is looking for a deal to address tariffs and Chinese practices such as access to Chinese courts to address civil business litigation, the safety of intellectual property owned by Americna companies, access to Chinese markets for American goods, and other specific, substantive Chinese bad trade practices.

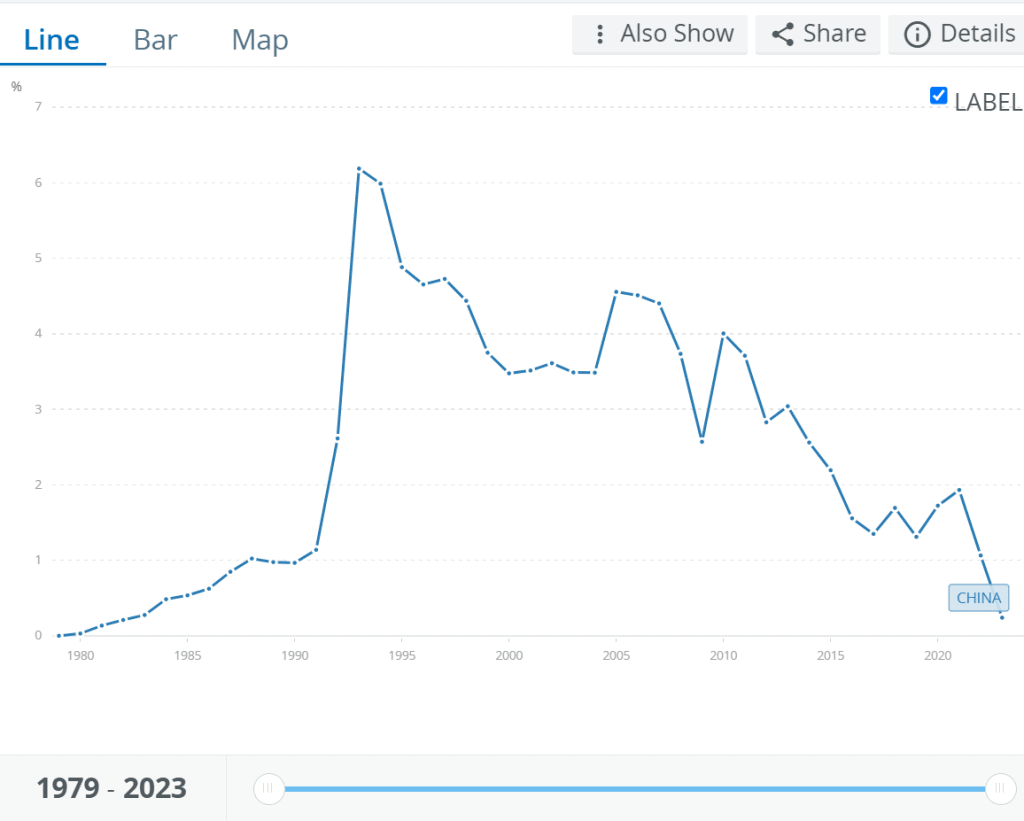

2. The Chinese — desperate to maintain face and not to look powerless in the eyes of the world but dealing with a dicey economy themselves — want to export their many goods to the United States, the most powerful and robust economy in the world.

We are now seeing the impact of tariffs in American ports with a meaningful reduction in traffic. Continue reading →