Big Red Car here. Still drying out from the rains last night and today. We need the rain so I can’t complain. Who would listen anyway?

So I’m talking to a cute little Mercedes Benz convertible (top buttoned up, mind you). She lives with an accountant and we get talking about the cash flows of our country. Not politics, mind you, just how much is coming in and how much is going out and how much we are borrowing.

Me and the cute little MB try to get all the divisive “who shot John” politics out of the discussion and try to just understand the basic cash flows at work here. Cause her Boss says — “We got a basic cash flow problem.” And, hey, I believe her and her Boss. Her Boss is an accountant.

Revenue

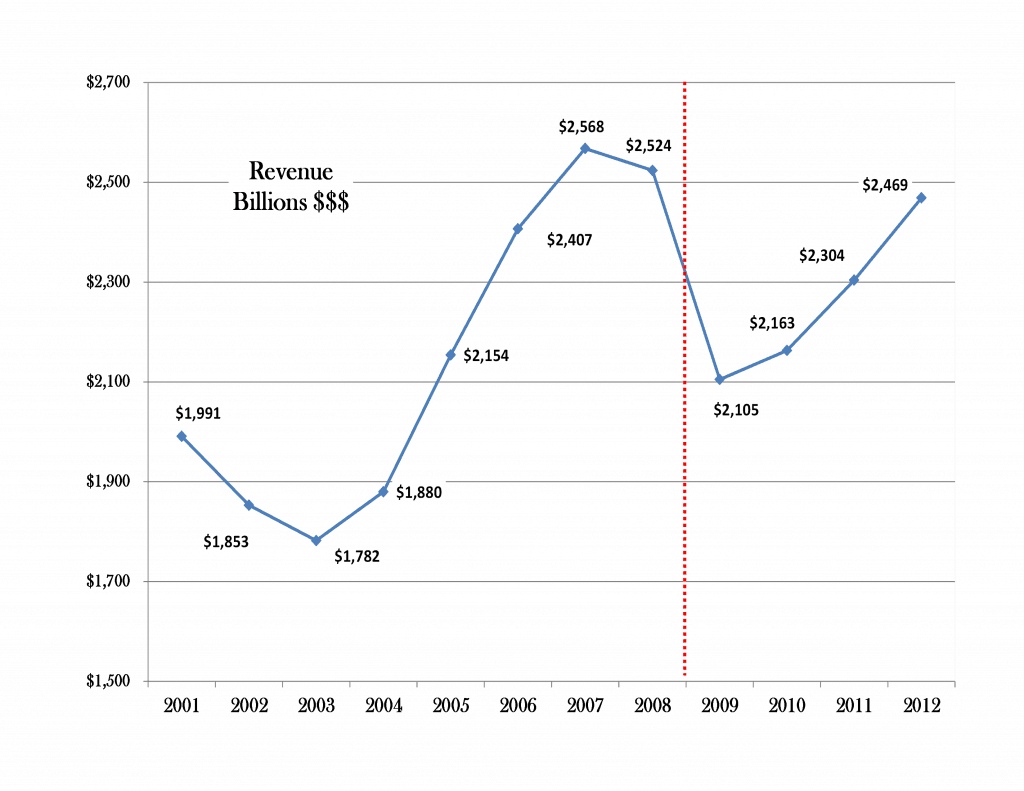

So, me and the cute little MB make a graph of what our revenue looks like and we come up with something like this.

Now I wanted to make this chart myself — hey, you think I can’t operate Excel, huh? I may be a Big Red Car but I can crunch the numbers with the best of them. As I said, I wanted to make this chart myself from raw data to ensure it was devoid of any tricks or political posturing.

The chart shows a very big dip starting downward in 2007, hitting bottom in 2009 and inching upward thereafter. It still doesn’t get back to 2007 levels of revenue even in 2012 and the forecast for 2013 may be that it edges down — that’s right down.

So revenues between 2003 and 2007 were up substantially. Big time. Nobody really wants to acknowledge this improvement in revenue during the Bush years. But there it is.

Spending

So now we take a look at spending. What does the government spend? Theoretically all spending must originate in the House of Representatives but that is a bunch of malarkey. Haha, Joe Biden — a bunch of malarkey!

The reason it is a bunch of malarkey is that we have some programs which we don’t know how much the spending is really going to be until we add it up at the end of the year. The government by the way is on a “fiscal year” which begins in October and ends in the following September.

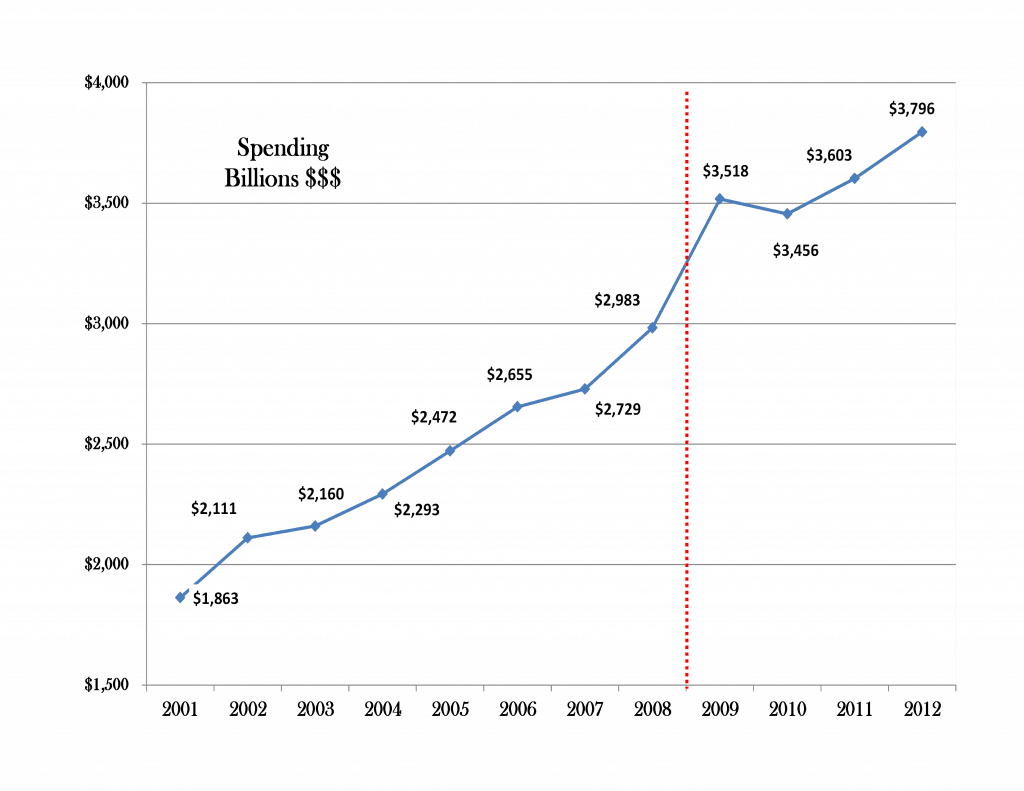

So here is what spending looks like.

As you can see, spending just keeps going up and up and up and up. This is regardless of what is happening with revenue. This is the real spending picture right here, folks. It just keeps going up during a period of time that folks are supposed to be tightening their belts just a bit. Hey, we’re likely still in a recession and spending is going up and up and up.

To make today’s revenue match some level of spending we would have to use today’s revenue and the spending from 2005. Take a look and see if you agree. So we would have to go back about 7-8 years. Does that sound doable to you?

Who is responsible for controlling spending? Really, who?

Net cash flow (deficit)

So when you subtract spending from revenue you arithmetically derive your net cash flow. Haha, that came from the cute little MB, not me. But she is perfectly correct. Net cash flow.

If it is positive — more revenue than spending — then it is a surplus.

If it is negative — more spending than revenue — then it is a deficit.

If you have a surplus, you can use it to pay down the national debt.

If it is a deficit, you have to borrow that much money and it accumulates as part of the national debt. The national debt is increasing. Look at the upper right hand corner of this page and you can see the national debt. It is increasing like crazy.

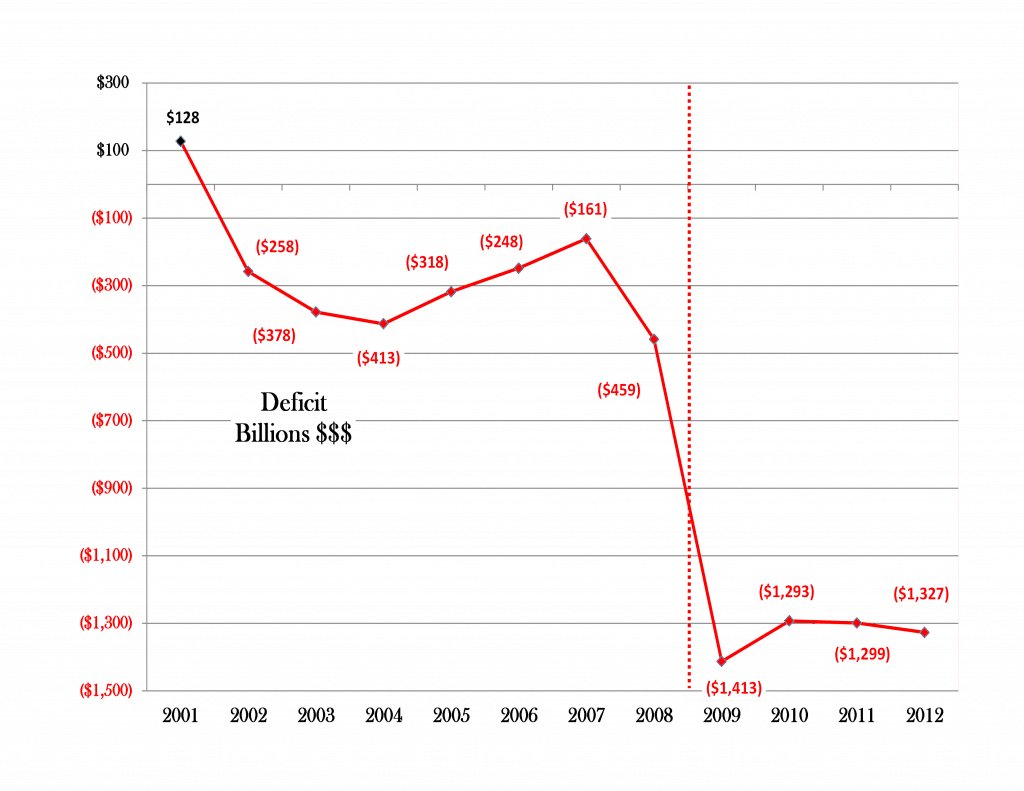

OK, so here it is.

As you can see, it is not a pretty picture. The deficits are now running almost $1,500,000,000,000 a year with no end in sight. That is trillions. Again, if we could get back to the Bush years, things would be a whole lot better.

Hope and Change

So what is going to have to happen? We are going to have to change something and it looks like spending is the one thing we can control with certainty.

I hope we can do it. Because if we do not, we are in for a very, very, very tough time.

Now folks in Washington, according to the cute little MB and her Boss the accountant, want you to believe this is a complicated problem. It is not. We have a spending problem. Which has caused a cash flow problem. Right now we are filling the gap by borrowing money from folks who will expect to get repaid some day. That day cannot be postponed forever.

And we are going to have to do more than just hope for a change. Hoping for a change is not a financial planning tool or strategy.

Our National Addiction

We are a nation of crackhead borrowers and spenders. The Congress — both parties, mind you — cannot resist the temptation to spend and kick the can of spending control down the road. That is neither responsible nor pragmatic. It will not work much longer.

But, hey, what the Hell do I know? I’m just a Big Red Car. But even a Big Red Car can see the inevitable.

Be kind to yourselves, you deserve it.

Pingback: The Truth About Tax Cuts - The Musings of the Big Red Car

The revenue between 2003-2007 is phenomenal. Any particular reasons for this? in other words was it too much consumer spending and home buying spree that led in part to the 2008 debacle. Also, in my opinion the graph for the debit would be better if the y-axis was reversed. Overall, a very clear and post!

.

Everyone has gotten so wrapped up in their Bush-hating underwear that nobody is willing to admit how good the revenue was under Bush. Those deficits look like Heaven now.

Even Bush let the spending get away from him — Medicare drug benefit, Iraq war, A’stan war, Dept of Homeland Security.

Most of that could have been avoided and he would have been running huge surpluses.

Funny thing is that as Governor of Texas, he was as tight fisted as a tick.

You can’t eat 10 cheeseburgers a day.

.

I guess the notion that Washington changes people is true even in the case of Bush!

.

It did not change Reagan. And that may have been his genius. It seems to me that politicians go to DC and arrive in awe. Reagan had nothing to be awestruck about. He knew everyone and he was a huge man in Hollywood. Plus he had real charm and style.

He was a two time Governor of California and thus had all the administrative skills and governing sense of process.

I recently read a compilation of his personal letters and was struck at how much in command this guy was. He was not afraid to reject the advice of career diplomats in the State Department.

Everything I see with our current President strikes me how he operates on the ragged edge. He is always just an inch from disaster and tone deaf to boot.

.

was that a surplus in ’01?

.

Si, nobody remembers that. Even dumb old Bush was able to make a positive number appear.

.

I read an interesting take on Clinton’s surplus and where it came from http://www.businessinsider.com/how-bill-clintons-balanced-budget-destroyed-the-economy-2012-9

.

Easily one of the best articles ever written on the entire Clinton “surplus”.

Folks are totally blind to the fiction that the “budget” does not include inter- and intra-government transfers (like SS) and that the National Debt increased every year Clinton was in office indicating that there was no bottom line surplus though the budget was generating cash.

The politics of the situation may have been the special sauce. Gingrich’s Congress slowed the rate of growth. SLOWED THE RATE OF GROWTH

They did not cut anything.

That is all that is required now — to cut the rate of growth and then to trigger some growth.

This article should be required reading and some folks should have to get it tattooed on their chests.

Well played.

.