Wait a damn second, Big Red Car. Canadian softwood lumber? A grudge match? What? You got some ‘splaining to do, Big Red.

Big Red Car here on a grayish Tuesday. Still, on Earth as it is in Texas, y’all!

So President Donald J Trump has fired his first shot in the centuries old trade dispute between the US and Canada over the export of Canadian softwood lumber to the US, by imposing 90-day retroactive countervailing duties on Canadian softwood lumber exports of up to 24%. Hello, Canada!

Everyone was expecting the trade wars to start with Mexico or China. Nope — Canada.

Game on, y’all. And, President Trump started it, just like he promised he would. [Promises made, promises kept.] Get some popcorn, a lemonade, and a seat.

This has been a sore spot for so long it is a sore spot within a sore spot.

First, let’s know this is a complex issue with a bunch of talking which has gone on for so long it has bridged more than a dozen US administrations.

Let’s review the bidding, shall we?

Where did this come from, Big Red Car?

The issue has been around forever and at the core is one fact: The country of Canada and its provinces OWN the standing timber from which Canadian lumber is made. These two legal entities decide at what price Canadian lumber manufacturers will buy timber from which their lumber is made. What could wrong with that, Big Red Car?

Whenever governments pick winners and losers, they screw it up. They can’t help themselves.

US timber interests are private. The government has no role in the production or pricing of US timber. The market decides US timber pricing.

It is a big business in Canada.

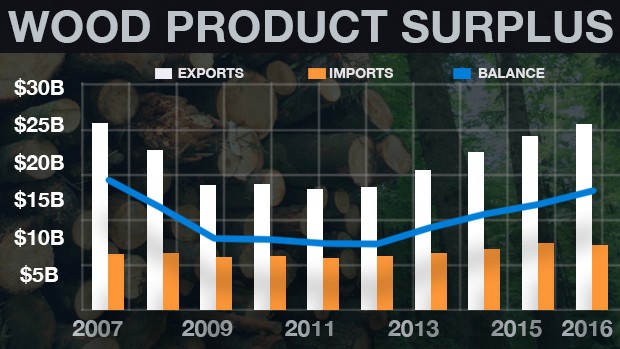

As you can see, Canadian exports are growing at a time when imports have been steady for a decade. This is a growth industry for Canada.

The Canadian lumber industry directly employs 250,000 and has another 300,000 related jobs. Canada has about 16,600,000 jobs currently filled. Big industry for Canada.

Mix governmental ownership of a critical asset and employment for citizens (voters) and you have a recipe for manipulation.

Canadian Softwood Lumber Markets

The US represents 70% of all Canadian lumber exports. Think about that for a second. The US is Canada’s largest trading partner.

This should create a lot of power on the side of the buyer of Canadian lumber, but it has not.

US 2016 exports — $297.7B. The US is Canada’s largest trading partner! The US buys 76.3% of all Canadian exports.

China 2016 exports — $15.8B. China is Canada’s second largest trading partner! Huge difference between #1 and #2, eh?

See why this is so damn important to Canada? I thought you would.

In the US, Canadian soft wood lumber is used for homebuilding. Homebuilding is a critical US industry.

Canadian Softwood Lumber Agreements

The US and Canada have pretended to work on this problem with great earnestness since 1982 and there has been Lumber I, Lumber II, Lumber III, and Lumber IV agreements. [Not to go ugly on an ape, but the US gets its ass handed to it on these type of negotiations. President Trump is right about this. Even the Canadians are laughing at us.]

There were a number of other agreements, including NAFTA, which bore on the dispute. The most recent, The Softwood Lumber Agreement, expired in October 2015 and a one year moratorium expired in October of 2016 — three weeks before the US election.

The time to deal with this has just arrived. This is why the problem has materialized now. The agreements and a moratorium have all lapsed.

Disputes revolve around two concepts:

1. Countervailing duties imposed when a product’s costs are being manipulated by a supplier. This requires a complaint from more than 25% of the US industry for the government to act upon this concept. Done!

2. Anti-dumping duties imposed when a producer is selling goods below their cost to manufacture. This is the next step. [This is the basis for the US-China dispute on steel.]

Both of these notions are in play, but the Trump administration has struck using the countervailing duty approach by imposing tariffs of up to 24% on Canadian softwood exports.

This is no head fake. President Trump has done this. This is like when President hit Syria. It is done. Your move, Canada.

Digressions

Allow me several digressions:

1. One of the things I am beginning to admire about President Trump is he doesn’t allow things to drift or follow inertia. He is a man of action.

His Commerce Secretary, Wilbur Ross, is a quick study and unafraid to act. Deal makers both, but no baloney guys both. Refreshing.

A long standing problem appears on his desk — immigration, the EPA, China, Syria, North Korea — he does something about it in real time.

This guy. This no nonsense, pissed off guy. He’s the one shaking things up in the District of Columbia. Just like he promised he would.

2. If you are the largest buyer of a country’s products and you are the largest user of that company’s softwood lumber, you should be able to call the shots based on buying power. The US never throws its weight around as it relates to the unique strength of its buying power.

The world is going to have to pay a price for access to the US market. [BTW, right now Canada has effectively banned US milk products. Huh? They get unfettered softwood lumber access to the US and the US milk industry takes a kick in the udder? No way, Jose.]

Well, that is until now. President Trump is not going to let diplomats and trade reps call the shots.

3. Hidden in the details is the issue of jobs. How about if all that Canadian lumber was replaced by US lumber?

There are more than 500,000 jobs — damn good paying jobs — at play here. Do not imagine for a second President Trump doesn’t see this?

One misstep by Canada and those jobs are going to Georgia, South Carolina, Florida.

4. There is no question the Canadian government and the provincial administrations are manipulating the price at which they sell standing timber to Canadian lumber companies.

It impacts their citizens (voters, y’all) and the local economy. It is real.

If you were running British Columbia, you wouldn’t put a thumb on the scale to keep happy voters? Haha, yes, you would, wouldn’t you? Cause you’d be a politician and that’s the kind of stuff politicians do, right?

5. The Canadian timber companies know this is coming. They have known this for years and they have acted upon that knowledge.

They have been on a ravenous binge to buy and start US sawmills. Some of these companies own more US sawmills than Canadian sawmills.

6. If the US imposes this duty — which they have — US timber will become more attractive. US lumber company revenues will increase. US lumber company payrolls will increase. Workers will receive more money. More income means more US tax revenue.

This is how America gets great again, no?

So, there you have it, dear reader. This is why the Trump admin is acting in regard to Canadian softwood lumber exports. It’s about agreements, timing, price manipulation, and cojones.

This is a good thing and I applaud President Trump for jumping into the middle of a centuries old problem. Bravo, Mr. President. You got my support.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car. President Trump — you’re doing great. Thank you.![]()

Not a fan of tariffs despite the politics. You also can’t CUT a lot of timber in the US. EPA and environmental regulations and endangered species. Lumber prices in the US will be artificially high when you take away the manipulated market from Canada. American consumers benefitted from the lower prices, as they do with Chinese steel.

.

Not sure I agree with you about the timber obstacles in the US. A lot of it is the lumber companies are wary of bumping into the Canadians. They are very good timber and lumber men.

The Canadians have bought up and started a ton of sawmills. They are sourcing US timber and making lumber in anticipation of their Canadian operations running into exactly the buzz saw they have.

You have to remember this all revolves around a treaty expiration and a one year moratorium. While the fight has been going on for a long time, it is only last 2016 the US had any flexibility.

DJT should take care of the regulations.

There are a couple of low hanging victories waiting to be plucked — the maquiladoras in Mexico and lumber with the Canucks.

BRC

https://www.themusingsofthebigredcar.com

Which costs the US purchaser more — Canadian lumber or US lumber? (serious question I’m asking).

My guess is that Canadian lumber costs less, else why wouldn’t we be buying our own domestic lumber. But I’m looking for the facts on this.

Either way, it seems to me that the lowest priced source would be the preferred source. Agree?

My line of questioning wants to get at whether or not these 24% tariffs are going to have us paying more for lumber. And if that is the case then how is that good for us.

.

Of course, the premise of the issue is that Canadian lumber is cheaper — in the short term. It is made cheaper through illegal price manipulation.

But, who are we tasked to protect — the consumer or the producer? The answer is BOTH.

Lumber is a commodity and it trades on the CME. Big builders speculate in lumber futures and can take delivery of contracts as they use that much lumber in their operations.

Like chemotherapy, the patient will get better, but not until a period of discomfort is experienced.

In the short term, prices will rise, but they will be offset by the continued decline of the Canadian dollar (on all goods, not just lumber) and, then, the beautiful, lusty bitch called the “market” will slip off her negligee and treat us to a flash of her brilliance.

American suppliers will pick up the slack. There are millions of acres of American (think Southern pine) lying mature to be cut and lumbered.

Capacity — sawmill capacity — will increase and the supply chain will shorten and go through Georgia, South Carolina, Florida. [Note that Canadian lumber companies have been buying and building sawmill capacity in the US for decades. They know where this is headed.]

In the end, US jobs will be created. Wealth will be created. US tax revenues will get a shot in the arm. Prices will be driven by market forces and not manipulation.

The Canadian government and provincial administrations are picking winners (them) and losers (American lumber companies) by manipulating the stumpage price.

Free trade is good. Fair trade is better.

BRC

https://www.themusingsofthebigredcar.com

> And if that is the case then how is that good for us.

The bad news is that builders will pay more for lumber, and US houses will cost more.

The good news is that the US will have a softwood lumber industry again, with its jobs; some US workers will go back to work instead of languishing on welfare and depression; the US will have some leverage to be able to sell milk to Canada, will run a smaller foreign trade deficit.

With a smaller foreign trade deficit, the US may have a stronger US dollar which will make it harder for US companies to export and more attractive for the US to import. Just why the US dollar is so strong while the US is running supposedly an $800 billion a year trade deficit I don’t know.

But supposedly the US has 90 million or so workers out of the labor force. Putting those workers back to work should generate more tax revenue and reduce welfare expenditure, help family construction, etc.

For exporting, I never saw just why the US should do this: E.g., GM and its workers build a Chevy, and we export it. Then we get paid in whatever, some foreign currency, US dollars currently overseas, gold, etc. For the foreign currency, we sell that on the foreign exchange market for US dollars which tends to make dollars more valuable. Then GM gets the US dollars that came from overseas.

So, net, US workers produced a car, and the US economy got some dollars. So, now here in the US, we have more dollars chasing the same quantity of Chevys and other goods, that is, that Chevy that got exported did not add to the goods for sale in the US. Well, usually we believe that more dollars chasing the same quantity of goods causes inflation.

Or, here is what seems like a better solution: If we want more dollars, then just print some. For that Chevy that got produced here in the US but got exported, just keep that Chevy here in the US. So, now we have more dollars chasing at least somewhat more goods.

If we want to sell Chevys overseas in exchange for, say, tin or natural rubber we don’t have, okay. But we are already importing lots of stuff and, really, don’t want to import more since that tends to put US workers out of work.

It’s easy to understand why, say, Microsoft wants to export: They get the dollars. And for jobs, then Microsoft gets to hire more US workers. Microsoft gets to export because their

products are desired in foreign markets. And since Microsoft’s products are from close to zero marginal cost, exporting their bits and bytes does not reduce the Microsoft bits and bytes available in the US.

But one way an another, we can’t continue to have 90 million workers out of work because some foreign countries are determined to sell cheap into the US.

Sounds to me like Canada should just keep their lumber and build more houses for the citizens of Canada. Or, maybe Canada wants to export lumber so that they can buy more Chevys and more Microsoft bytes.

Altogether, I’d like to be much more and better informed on all these issues, including the relevant economics. Here BRC is beating the snot out of all the MSM who’d much rather scream about some made-up, cooked-up, stirred-up, gang-up, pile-on, total nonsense fake news than foreign trade, economics, 90 million people out of work, etc.

Yes, for a first-cut, qualitative analysis, the tariff on Canadian soft lumber will go to the US Treasury and, thus, lower the Federal budget deficit, require less borrowing from overseas, lower the value of the dollar, make it easier for US companies to export, etc.

But, generally, we would expect that it would be better for the US dollar to be more valuable, not less valuable.

Yeah, today the MSM is headlining the fact that Ivanka got a boo in Germany and applauding the fact that a leftist San Francisco judge blocked Trumps ability to withhold funds from cities hell bent on bankrupting the state via illegal immigration. Sum Ting Wong!

.

I am way more upset about Ivanka getting booed.

BRC

https://www.themusingsofthebigredcar.com

.

So we’re at war with Canada over softwood lumber? Huh?

https://themusingsofthebigredcar.com/us-v-canada-timber-grudge-match/

The Big Red Car ‘splains it to y’all. Read it and understand, eh?

BRC

https://www.themusingsofthebigredcar.com