Other day I am scanning a blog post from what was once my favorite blog. The author uses the words “monetary policy” and “fiscal policy” in a manner that reveals he has no earthly idea what they mean, but they sit nicely in the sentence and give off the erroneous notion that he is an erudite and educated observer of the condition of the world and our economy.

So, your Big Red Car will tell you what they actually mean.

Monetary policy and fiscal policy are not interchangeable. They mean different things.

Monetary Policy, come on, Big Red Car

Monetary policy for the United States of America is enacted by our independent central bank, the Federal Reserve.

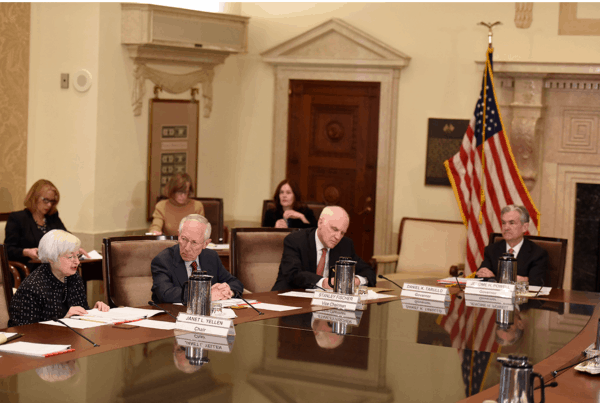

Federal Reserve Board — lots of old white people who wear French cuffs and suits, red ties, big clean conference tables with glass tops and fingerprints

The Fed seeks to achieve some macroeconomic balance amongst price stability (inflation), full employment, and stable economic growth (interest rates are a part of this, obviously). You can easily understand why these objectives are related and intertwined.

Technically, the Congressional “mandate” when creating the Federal Reserve was maximum employment and price stability, but you can understand why stable economic growth is part of that dual mandate.

The tools that the Fed use to achieve these objectives are the bully pulpit, research into the state of the economy, communication of basic data, and setting the Federal Funds Rate, which is the rate that banks charge each other for short term loans.

The FFR is the malleable bellwether rate from which other rates are influenced or derived.

The Fed’s Federal Open Market Committee meets 8 times per year and makes a survey of the state of the economy prior to the meeting and opines as to what their policies will be after the meetings. It is like the economy going to the doctor for a physical 8 times per year including a long fingered prostate exam and some time in the stirrups.

The insights gained and given are granular as the Federal Reserve has 12 banks that operate 24 branches.

While the Fed governors are appointed by the administration in power, the Fed is theoretically independent of the White House.

The Fed has been doing a helluva job as we have almost zero inflation and have had periods of explosive growth in the last 4 years with still no inflation.

The Fed is wary right now with our Pandemic Economy, but has been making all the right moves, continuing interest rates that support recovery. They seem, to me, to be more fine tuned and watchful than ever before.

In a very broad, but valid sense monetary policy is the response to the conditions created by fiscal policy.

Fiscal policy, come on, Big Red Car

Fiscal policy for the United States of America is enacted by the Congress and the Executive Branch.

Fiscal policy objectives may — will — change from administration to administration.

Generally fiscal policy focuses on taxes, spending, debt, incentives, and broader policy.

If a government decides to raise taxes, thereby withdrawing free flowing capital from the economy, one may reasonably expect economic vigor and growth to slow.

If a government decides to inject “stimulus” into the economy — like COVID Relief Packages — then one may reasonably expect economic vigor to increase or, at the very least, see the rate of decline slow.

If we are a nation that has achieved energy independence and are enjoying comparatively cheap gas prices (gas prices are a general tax on everything and everybody), then we are positioned for growth.

If, however, a new administration takes office and immediately cancels energy projects, cancels oil drilling, cancels oil leases, bans fracking, and takes other actions that will serve to diminish growth, then we are positioned for higher energy costs, contraction v growth, and a less robust economy.

Higher gas prices will still be a general tax on everyone and everything, just at higher rates.

Let’s be clear — if you cancel a project like the Keystone XL Pipeline, you will not solve the lost jobs issue by telling the welders that the solar power industry is going to be really hot in a few years.

This is all fiscal policy.

The confusion of inconsistent fiscal policy

The issue that raised this discussion was peripherally related to this — can an admin have inconsistent fiscal policy and thereby send conflicting signals?

Yes, of course.

On one hand an admin can swoop down and kill our energy independence — which is a huuuuuuuuuuuuuuuuge thing — while also shipping out money in a stimulus program.

One side of their face is saying, “Whoa, Trigger” whilst the other side is saying, “Giddyup, Old Paint.”

That is the worst kind of fiscal policy — one that takes with the left hand and gives with the right hand. It is self-cancelling. It is confusing. It is folly.

Bottom line it, Big Red Car — meeting friends for drinks

OK, here is it. Know the difference between monetary policy and fiscal policy.

Know what they are, who controls them, what tools they use, and that they can be inconsistent.

Understand the linkage between fiscal policy, resultant monetary policy, and how harmful it can be to have inconsistent fiscal policy.

Drink a Sazerac for me. Here are the ingredients, plus a splash of simple syrup. Invented in the 1830s in New Orleans.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car.