Big Red Car here and awaiting the results of tonight’s Iowa caucuses. Why do we care what a bunch of very white folk in Iowa care about anyway?

Foggy and 80F today. Ahhh, winter in Texas!

So, we’ve heard of the lost Japanese Decades, right?

Did you know we’ve got our own Lost American Decade? The Lost American Decade!

The characteristics are the same as the Japanese debacle — low interest rates, low inflation, and low rates of growth. Do not say it — the “new” normal. Ugh.

OK, here’s an interesting graph — Real GDP per Capita. [dshort.com to be thanked here, thank you, sir].

This marries inflation adjusted GDP (gross domestic product) with population growth thereby stripping bare the impact of inflation and the growth of our population (which could be considerable over a decade, no?)

Go to 2005 and connect the dots. Just about flat for a decade.

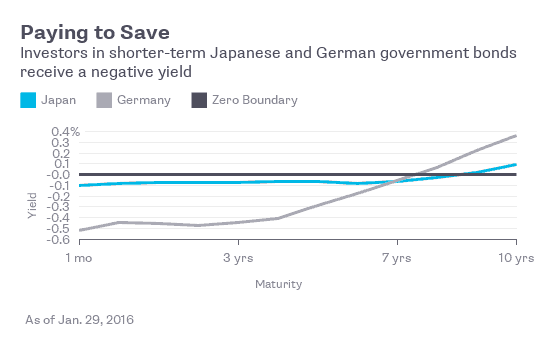

In Japan today, they are charging to hold big cash deposits overnight. Look at this graph.

Warning: This is a gross oversimplification but it stands for the proposition that both the Eurozone and Japan are not exactly growing robustly. Sounds like the United States, no?

Here is a good article on Negative Interest Rates. Read it.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car. Happy Iowa, y’all!

There’s an old remark: “Deflation is the easiest problem in the world to solve — just print money.”

So, have the Fed loan about $1.5 trillion to the US Treasury. So, the Treasury gives the Fed an IOU for the $1.5 trillion.

Then the US Treasury sends a check for

1,500,000,000,000 / 330,000,000 = 4,545.45

dollars to each of the, assume 330 million, people in the country. Maybe the Fed never asks the Treasury to pay back the money.

If that doesn’t get people spending and companies hiring and producing, then do it again. Keep it up until it works. I suspect that fairly soon it will work.

E.g., from 1929 to 1941, we went right at 12 years with our economy flat on its back with gigantic suffering in the US and about all of the industrialized world. Why? Because (1) during the 1920s, banks loaned money, people deposited it, the banks loaned it again, people deposited it, the banks loaned it again, e.g., to buy stocks, and, thus, we enormously increased the money supply, the economy roared, the Roaring 20s, and the stock market blew a bubble. Then, as tends to happen, the stock market bubble burst, prices fell, and lots of people suddenly owed a lot of money they had no chance of having. Due to fractional reserve banking, the banks that made the loans couldn’t give depositors their money back. The banks went bust. We suddenly had no more financial system, and the money supply shrank to next to zip or zilch. No one had any money. Everyone who had borrowed had no chance of paying off their loans, Everyone who had saved with their money in a bank lost it.

We just sat there like that for 12 horrible years. The loss in psychological capital is still with us. People who owned a farm outright and could live off the land were about the only people who could do okay. A lot of the farm country returned to a barter economy, e.g., pay a school teacher with a chicken. That is, essentially everything in our economy except self-sufficient farms was destroyed.

Solution? Sure, print money, replace some of what was destroyed. But, printing money sounded so sinful we refused to do it. A lot of people suffered and died. Disaster.

Then people started shooting at us. Presto. Bingo, we were ready to print money and did, and suddenly, in 90 days, everyone had a job with offers of 1-2 more. We were back to work with the economy going again. When the war ended we had massive inflation? Nope.

We could have had everyone back to work in early 1930.

Did I mention, “Deflation is the easiest problem in the world to solve, Just print money.”

And, why do we have to print the money? Because when the bubble burst, we destroyed a lot of money, e.g., that created by the fractional reserve banking system. Since the crash, we have not printed enough money.

As we print the money, likely on the Forex, the dollar will fall which will mean that the US can have more jobs to export products and import less and, then, have still more jobs manufacturing what we used to import with a strong dollar. Right, net, the economy will get going again.

Sure, if we print some money, then the fractional reserve banking system, as it gets going, will create some more money and maybe ignite inflation. So, just increase the reserve requirements and/or the Fed funds rate.

Or, just have the Fed ask the US Treasury to pay back some of the money that was printed, which might be fairly easy to do if tax revenues rise due to the increased economic activity.

Or, somehow the engine of the US economy is short on oil, so we need to pour in more oil.

Prime the pump. Get the ball rolling. Get some growth expectations so that people will start to borrow and make capital expenditures to be ready to serve the customers about to come with money and ready to buy.

History indicates that we can get people back to work and the GDP up in about 90 days.

We’ve got an unemployment rate of about 25% and about 95 million people not working. Biggie waste. Shot in the gut of the GDP, tax revenue, national security, standard of living, etc.

Print the darned missing money.

Look, on a farm, working with Mother Nature, we know how to be productive. The grass will keep growing, and the livestock will keep eating. All else in our economy and in our cities is just man made, and there’s no guarantee that it won’t just stop. Stop. Just stop. On the farms, the grass will still grow, but there is no good reason in a city the economy will keep going; instead, it is perfectly free just to stop. Halt. And just stay stopped, for full “lost decades”.

What’s the difference? A farm has Mother Nature and doesn’t need money to have the grass grow, the cattle and chickens eating, etc. But a city needs money. Without money, a city dies, as in dead. Just now, the cities are very short on money. So, we need to print some, replace some of what was destroyed when the last bubble burst.

Where am I going wrong?

.

This is just about over.

BRC

https://www.themusingsofthebigredcar.com

.

America has seen a flat GDP per capita for a decade. Agree? What does it mean?

https://themusingsofthebigredcar.com/the-lost-american-decade/

BRC

https://www.themusingsofthebigredcar.com