Big Red Car here on a bright, sunny Monday morning back from visiting My Perfect Granddaughter in Savannah. She is a perfect baby.

Sleeps through the night, naps well, eats like a champ and loves her Momma, Daddy, Mimi, and Gwantpa. She can even hold her toes when the thought grabs her.

Which, of course, got me thinking about Dollar General – wow, what a powerful transition, no?

Why Dollar General, Big Red Car?

Here’s why, dear, beloved reader. Since it went public in 2009 at $21/share, the stock has done nothing but perform hitting a recent price of $107.84.

Dollar General – DG – a very nice chart over the last 8 years since its 2010 IPO. Company was founded in 1939. If you bought at the IPO price of $21/share in 2009, you have a nice five bagger on your hands over the last nine years.

I used to tout the stock as being a perfect example of “staying in one’s lane and sticking to one’s business” but they are mixing in a bit of on-line shopping these days.

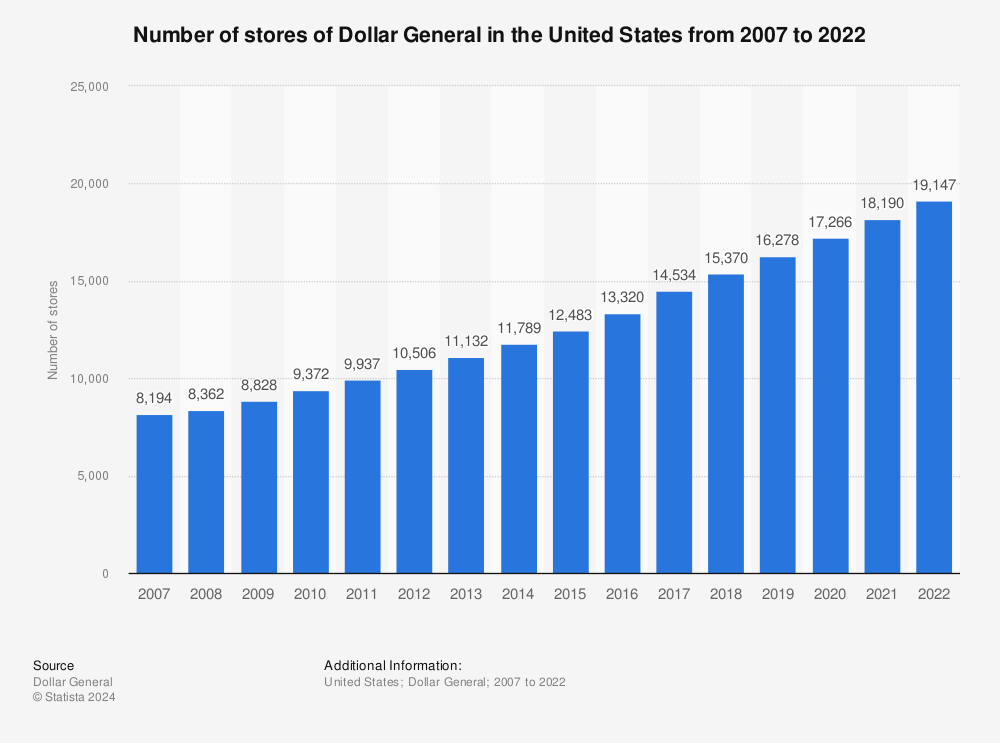

DG has a nation wide footprint with a spread of distribution centers. The company has almost 15,000 stores – Walmart, as an example, has 6,363 stores in the US.

Even though DG is the largest discount retailer, it still has ambitious plans for growth. It currently pegs its annual growth at 1,000 stores per year. You do the math.

Study this graph carefully. Sine 2015, the rate of growth has accelerated.

So what, Big Red Car?

What is interesting to see is what slow and steady can do for a company which sticks to its knitting. In the next few days, I will discuss venerable DG a bit more and sing its praises. In the meantime, take a look at this company which provides a great exemplar for any company considering how to scale.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car, y’all. Have a great week.![]()