If you have been following the events in the global economy since Liberation Day you have undoubtedly been confronted with many opinions as to the wisdom or folly of the actions of President Donald J Trump — the Tariff King/Emperor. Like everything in our complicated trade picture, there is far more than meets the eye.

If you own equities, it is even possible you are choking on some meaningful paper losses.

WTF is actually going on, Big Red Car?

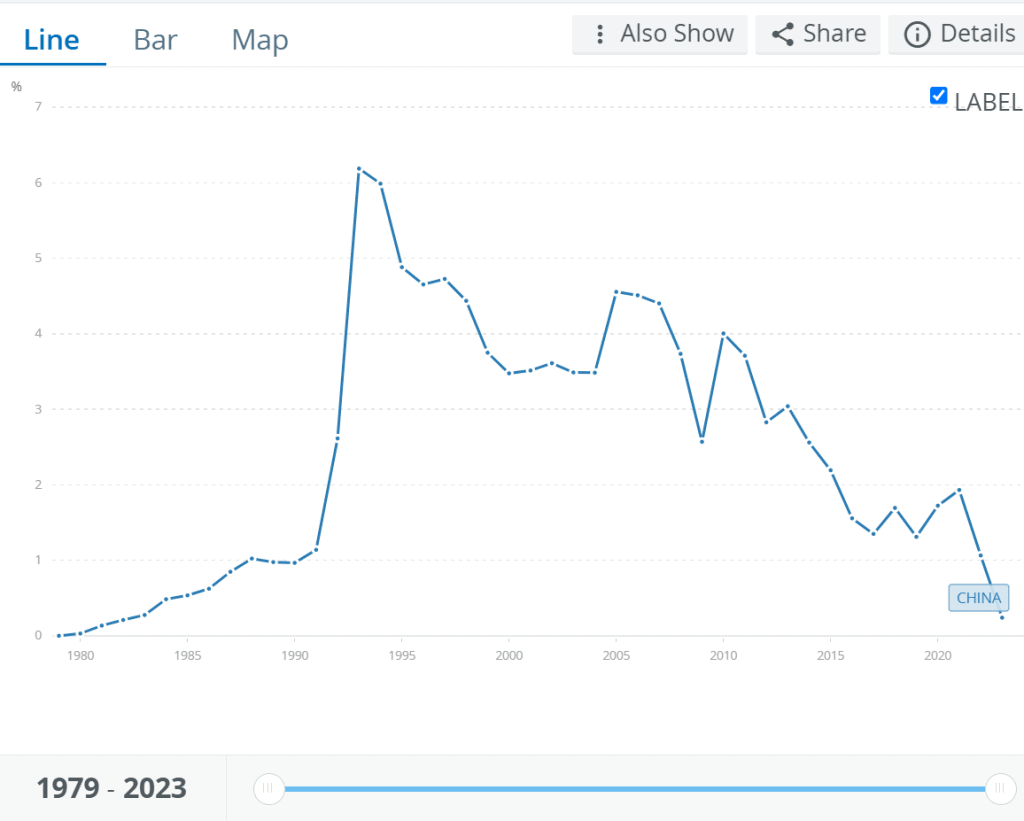

Well, dear reader, what you are seeing is a massive global trade RESET just like re-booting your computer when it fails to operate as it is supposed to do. President Trump, as he promised, hit the RESET button and imposed tariffs based on a concept of reciprocity.

This is part of Candidate Trump’s suite of financial campaign promises: to right size the government, to get rid of fraud, waste, and corruption, to reduce spending, to conquer inflation, to lower interest rates, and to put international trade on a fair and free footing.

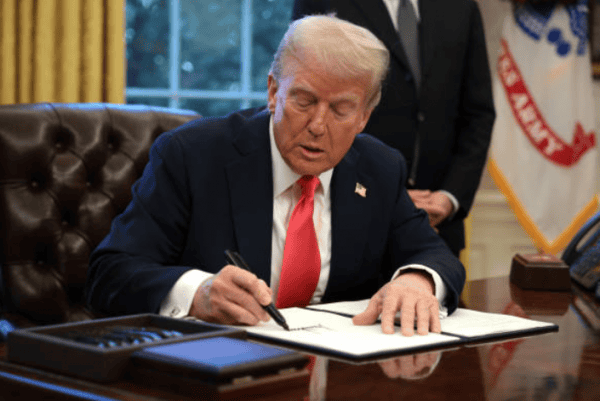

Leader of Israel, Bibi Netanyahu, meeting with President Trump — first in line to discuss tariffs and non-tariff barriers to trade. The parade is coming.

Part of that is fair, reciprocal tariffs. But, it is not just reciprocity, it is also what are called NTBs — non-tariff trade barriers — that have the same impact as tariffs, they restrain the ability of American manufacturers to obtain access to foreign markets and to have a fair chance to do business on a level playing field.

At its core, the Trump RESET is all about fairness. Continue reading →