Big Red Car returned from babysitting duties for My Perfect Grand Daughter. We are learning how to boogie board, but don’t tell her mother.

While gone, Facebook announced the impending creation of Libra, an asset-backed cryptocurrency that will transform life as we know it.

I have taken to calling the entire entire enterprise — Facebook, the Libra Association, and Libra — Facebank.

Bit of cynicism on a Sunday — we can’t trust Facebook with our data, so let’s trust them with our money? OK, had to get that out of the way, let’s march on, shall we?

Give me the basics, Big Red Car

OK, dear reader, here are the basics:

1. Libra has a website that lays out the entire story from their perspective. Go read it. It’s a long read, but it’s what they want you to know.

The Libra Website

As you would expect, it is well done, slick, and informative.

2. On the Libra website is the Libra White Paper that lays out, in detail, what Libra is supposed to be all about. It is a marketing piece and one should be on guard as one would be with a used car salesperson.

The Libra White Paper

Libra sees its mission in life to create a “…simple global currency and financial infrastructure that empowers billions of people…” through their smartphones.

They believe that there are 1,700,000,000 adults out there who have no access to banking — traditional banking — even though 1,000,000,000 of them own mobile phones and 500,000,000 have Internet access.

Please note we are talking about two concepts — cryptocurrency and access to traditional banking services.

What remains unasked is why does this require a cryptocurrency? If you cannot pay your bills digitally today, why does tomorrow look brighter when you still cannot pay them with a cryptocurrency? Why not just pay them with your local currency? Why not just use Zelle or Wells Fargo’s on line bill pay service?

3. All of this is done with a large helping of virtue. There is a Messianic zealotry to the effort that makes it evil not to embrace it fully. A couple of gems:

“We believe that a global currency and financial infrastructure should be designed and governed as a public good.” OK, so WTF does that mean?

“We believe that people will increasingly trust decentralized forms of governance.” Stop laughing. Stop right now.

“We believe that we all have a responsibility to help advance financial inclusion, support ethical actors, and continuously uphold the integrity of the ecosystem.” Do you really?

If your bullshit meter is clanging, you are not alone. Suffice it to say that the sponsors of Libra would not be accused of having done much of the above, but I am a bit of a cynic of a public company whose founder retains complete voting control. That does not sound the same note.

4. The Libra Blockchain is the software that underpins the Libra protocol, something called the Libra Core, an open source approach. If you are really having a hard time sleeping, you may read this.

The Libra Blockchain Paper

5. The effort is going to be furthered by an “independent” body called the Libra Association. The Libra Association is an independent, not-for-profit organization headquartered in Geneva, Switzerland that will provide governance for the network.

There are currently twenty-eight founding members who are organized by industry: payments, tech and marketplaces, telecom, blockchain, venture capital, and nonprofit/multi lateral/academic institutions.

Payments: Mastercard, PayPal, PayU, Stripe, Visa

Tech and marketplaces: Bookings Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, MercadoPago, Spotify, Uber

Telecom: Iliad, Vodagone

Blockchain: Anchorage, Bison Trails, Coinbase, Xapo Holdings

Venture capital: Andreesen Horowitz, Breathrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures

Nonprofit, et al: Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking

By launch date in the first half of 2020, the Libra Association hopes to have 100 members.

What is noteworthy by its absence is the void amongst banks. If you are going to nibble away at the banking industry, I suppose you do not want them to learn what’s going on with the balance of the unwashed.

6. Facebook has been the driving force behind the Libra effort and has formed a wholly owned subsidiary, Calibra, to ensure separation between your social media identity — which they have done a questionable job of safeguarding — and your financial data. Because who doesn’t trust Facebook to do what’s good for you?

As a wholly owned corporate subsidiary of a public company, Calibra is subject to regulation as are all public companies in the United States.

Once Libra is launched, Facebook will take a step back and its sub, Calibra, will become just one of the boys who will run Libra, through the Libra Association in Geneva. They will have the “…same commitments, privileges, and financial obligations as any other Founding Member.”

7. As to the currency itself, it will be backed with a basket of currencies and assets — the Libra Reserve — that will dampen speculation and wide swings in value. This is different than a fiat currency that relies upon the full faith and credit of the issuing nation.

The United States, once upon a time, backed its currency with precious metals — silver and gold. Then, they “went off the gold standard.”

Libra is going to be backed by currencies and assets. This is an area for careful observation. Libra will fluctuate in value with the underlying assets.

Investors who provided capital to fund the Libra Reserve will receive dividends that will be set by the Libra Association. Get it? The folks overseeing the Libra ecosystem will be setting their own dividend rate.

It is important to note that Libra will only work well if there is a series of exchanges ready to convert Libra into local fiat currency at exchange rates that are consistent with the value of the underlying assets.

Libra should minimize volatility, but the proof is in the bid v ask of the exchanges.

8. So, now, we are left with the fundamental question — what the Hell is the argument for a cryptocurrency in the first place?

If you put in the time and study the proposition, you end up with something like this:

Cryptocurrency — as a digital currency — enables a holder to send money quickly to disparate locations. Think “bill pay.”

Cryptocurrency can be held in accounts that do not divulge the identity of the “person” who owns the account.

Cryptocurrency can be transmitted across national boundaries without permission of the underlying originating or receiving nation.

Cryptocurrency is secure. [Remember this is what “they” said, not what I think.]

Cryptocurrency may dampen the impact of unstable regimes and runaway inflation. Taking to you, Venezuela.

Libra wants to be known by the following attributes: “…stability, low inflation, wide global acceptance, and fungibility.”

Libra is going to make your smartphone your banker.

That, dear reader, is all there is to it. Nothing more. Is that enough?

What is the government going to say, Big Red Car?

Governments are notoriously touchy about money laundering, tax evasion, the funding of criminal enterprises, the funding of foreign intelligence operations (like meddling in elections with Facebook ads), the funding of terrorism, and the unregulated flow of cash to/from/across national borders.

The American Federal Bureau of Investigation has created a Money Laundering Unit within its Criminal Investigative Unit that works with the Counterintelligence and Cyber division to focus on third party money movers — professional money launderers, accountants, lawyers, brokers — and digital currency in particular.

In their targeting they focus on known money launderers, facilitators, gatekeepers, complicit financial institutions, and systems that provide the mechanisms to facilitate all forms of money laundering (and by extension tax evasion).

When governments see such things as anonymous accounts, cross-border instantaneous transmission, and permissionless transfers — they are rightfully concerned.

That concern turns into an investigation and that investigation is going to want to pierce any obstacle that prevents the government from learning the source of the money, the purpose why it is being moved, and the ultimate destination.

Who is going to say that the government has no interest in this information? Who?

The United States wants to know when you are taking money outside of the US in excess of $10,000. When you visit a foreign country, the American traveler must declare this nugget of info. This sets the tone and threshold for US government concern.

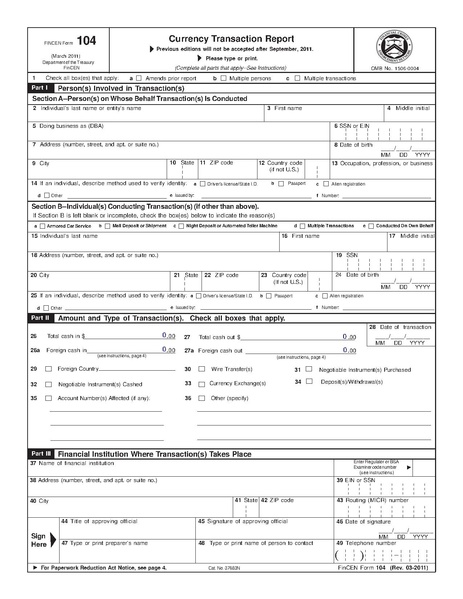

US banks have to report every deposit, withdrawal, foreign currency exchange/conversion, payment, transfer by or through the bank in excess of $10,000 on a currency transaction report (CTR). Here is the first page of the four page report. Click on it to see the amount of detail.

If the bank suspects/detects suspicious activity, they must create an SAR (Suspicious Activity Referral) which is done without the knowledge of the customer.

Further if a customer masks the $10,000 triggering threshold, they are guilty of violating the Federal law against “structuring” and both the bank employee and the customer can be punished.

All of this is digital. All of this is real. All of this is now.

Bottom line it, Big Red Car

Here is the bottom line, y’all.

1. Libra is going to happen, in part, because Facebook is used to dealing with the US Securities and Exchange Commission as a public company. All the amateur hour nonsense of companies like Kik/Kin is going to be lawyered over. Facebank will not quit.

Facebank is not going to launch in the face of uncertainty or opposition from the US SEC, the US Commodity Futures Trading Commission, the Internal Revenue Service, and the Department of Justice.

[Aside: There is ample precedent for the formation of organizations to self-regulate financial industries — the National Futures Association is one such organization. The problem for the Libra Association is they are focused solely on one cryptocurrency and not the industry. Oh, yeah, and they are headquartered in Geneva, Switzerland, huge message.]

2. The government’s concerns are not being met by the design of Libra. The government is not going to be receptive to anonymous accounts. This is why the Libra Association is headquartered in Geneva — a country for which bank secrecy is enshrined in their constitution.

3. There is really nothing novel here — this is Banking101 targeted on a bunch of folks who are “unbanked” while also targeting the 2,000,000,000 Facebook users.

The cynic within sees this as just another opportunity for Facebook to leverage its existing customer base. There is an Amazonian scent to this.

4. This is a bunch of cryptocurrency insiders — some trying desperately to save their own asses on prior investments that are looking dodgy — creating a standard for crypto that will strangle most of their competitors.

Eventually, a user will be able to pick — Libra or Bitcoin, but the smaller cryptocurrencies can meanwhile wander over to the funeral home and get fitted for a casket.

5. This deal will not launch in Spring 2020. Not a chance. This is going to require political support and the entire political infrastructure of the United States is already focused on the 2020 election.

6. The big banks are not going to sit idly by and let Facebank steal their customers. First, they will require the Libra Association to get a bank license in the US. Level playing field and all that rot.

Makes sense, right? Want to provide banking services? Get a bank license. Then, you will see the power of the US bank lobby.

Facebank has a better chance of eating newspaper and defecating money than getting a bank license under these conditions.

7. The Libra Association Founding Members are a huge pool of talent and smart people, but they are light on dealing with governments in the manner that banks do on a regular basis.

One of their strengths is their diverse interest in cryptocurrency. One of their weaknesses is their diverse interest in cryptocurrency.

Facebook is the only member who is strong enough and financially capable of seeing something like this through to the end, but they are also smart enough not to appear to control the enterprise because of their negative public image.

8. Blockchain and cryptocurrency have been looking for the “killer app” for a decade. This is not it.

OK, there it is, dear reader.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car. Be good to yourself. You’ve earned it.