Big Red Car here. The sun is shining in Austin and we are going for coffee this morning but not until I tell you an interesting factoid or two.

Revenue increased when the Bush Era tax cuts were enacted

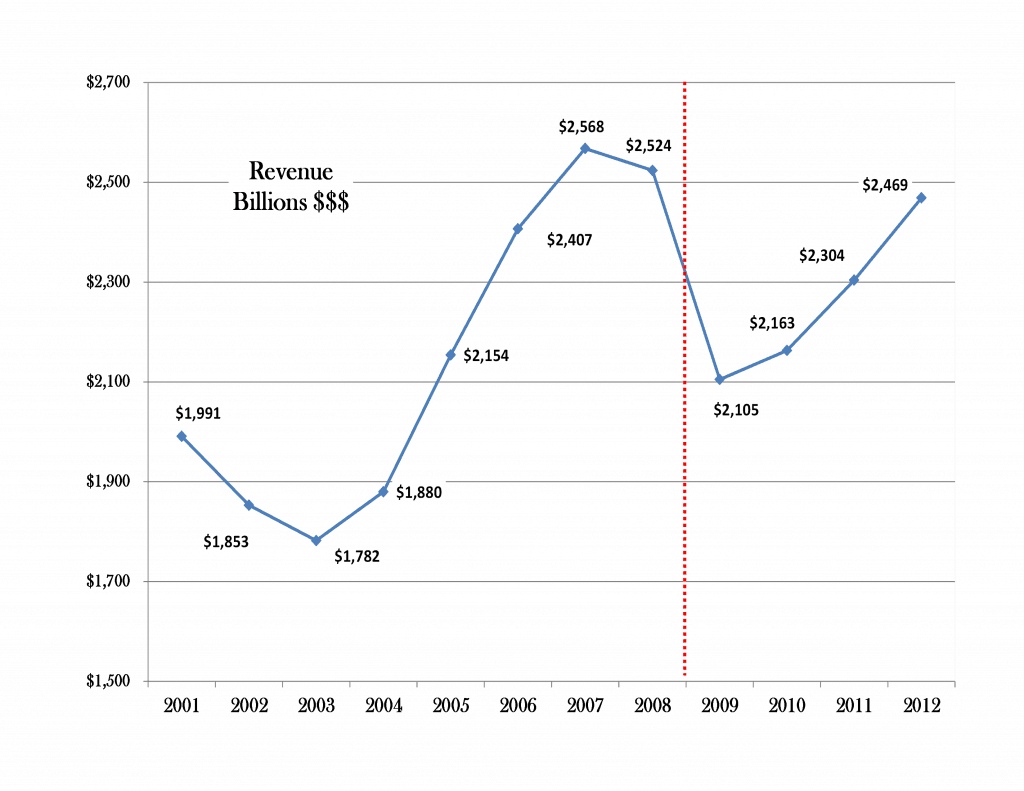

So a recent post about the Nation’s cash flow (link here) generated a bit of discussion in which a commenter — or should it be commentator? — noted that he was surprised that revenue had increased so much during the Bush years. He had seen the facts and the facts were clear. [pullquote]Revenue goes up when taxes go down.[/pullquote]

The Bush Era tax cuts dramatically increased actual revenues to the Federal government. Revenue goes up when taxes go down.

Here is that graph:

As you can see the increase in revenue from 2003 to 2007 was quite impressive. Most impressive!

So one has to ask oneself — why?

Could it have been the Bush Era tax cuts? The ones we are still talking about and which were recently extended for everyone except for nasty, greedy, selfish people?

The Bush Era tax cuts were enacted in the time period of 2001 – 2003. Look at the revenue thereafter. Look at it.

The Bush Era tax cuts spurred revenue. Revenue went up and it went up big time.

What was the real impact of the Bush Era tax cuts?

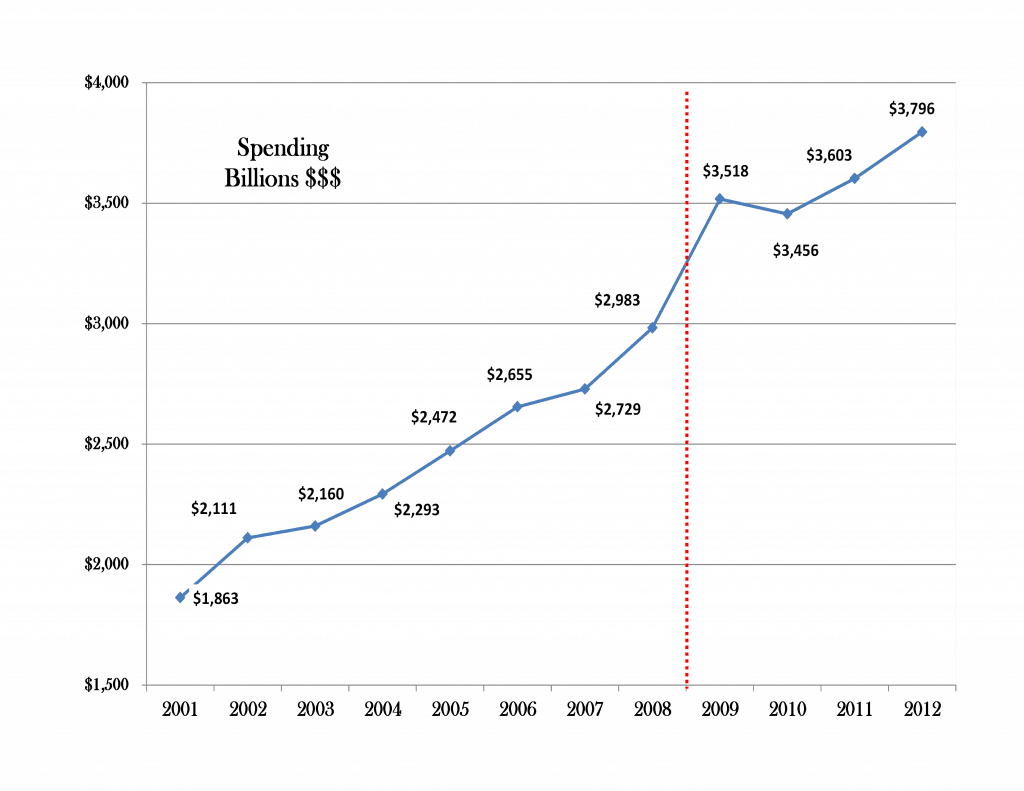

Contrary to the venom and nonsense spewing forth from Washington in general and the Administration in particular — the Bush Era tax cuts did NOT increase the deficit. It was the profligate and unchecked spending that did that.

Look at the rate of increasing spending. It goes up and up and up. Spending is the driver of our problems today.

Why, why, why?

The answer is very simple — when citizens are allowed to keep more of their own money they will spend it — even wisely sometimes — and the multiplier impact as it flows through the economy will spur growth which will result in more taxable income from the entire economy. Thus the increase in tax revenue.

The numbers don’t lie, people lie

These simple graphs tell the story that Washington does not want you to know or understand. You are a better steward of your own money than Washington is and that when taxes are reduced allowing you to keep more of your money revenue increases.

WE HAVE A SPENDING PROBLEM, FOLKS!

But, hey, what the Hell do I know? I’m just a Big Red Car.

Starting the graph in 2001 is part of the issue since revenues had fallen precipitously from 2000 – 2001 (though this was not Bush’s fault). Also, remember that EGTRRA was passed in June 2001 yet tax receipts fell sharply again that year. In other words, the economy recovering from the 911 / dot com crash / Enron era of 2000 – 2003 explains a great deal of the pickup.

http://www.heritage.org/federalbudget/current-tax-receipts

When you add another tax cut, doubling defense spending, a housing boom fueled by historically low rates and relaxed standards, and everyone using their homes like an ATM machine, you should see an increase in revenues, no? I think it’s fairly telling that revenues peaked the same year housing prices peaked…

I’ll conclude by saying that I think Romney lost a perfect opportunity here. Had he come in and said that he’d attack spending first, then refocus on cutting taxes once we reached a balanced budget, I think he would’ve won.

.

I am with you on everything other than the impact on revenue of anything other than tax cuts.

The increase in government spending is going to increase income. This is classic Keynesian economics whether folks embrace it or not.

The housing boom is going to increase revenue to the homebuilders and other contractors. Big multiplier effect in this industry.

The refinancing of existing homes is a tax free transaction.

Good times are felt across the board. Just as bad times are.

Nonetheless, the increase in tax revenues was fueled in great measure by tax cuts.

.