Everybody — meaning anybody with a functioning brain — acknowledges that the scourge of inflation is loose in the land.

The Fed — hats off to these guys for having kept inflation at below 2% for the last 10 years, well played guys — says it is “transitory” meaning it will recede, but they cannot define the driving force that will propel that movement.

Why will it recede? What will drive it back from the gates of the city? What force?

Nobody disavows inflation; they just say it is transitory, will be fine, or ignore it.

Shipping Costs as an exemplar of inflation

So, I did some research and came up with this particular example to underpin my opinion:

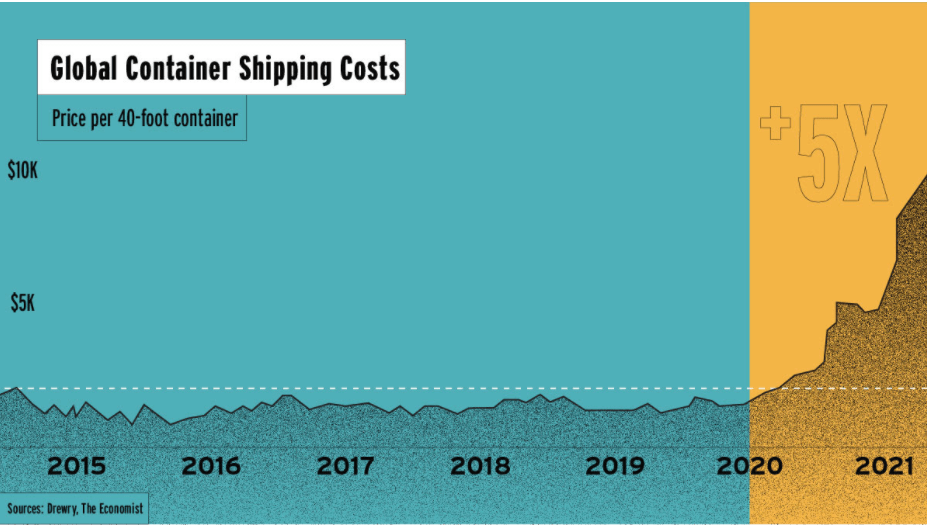

What you are looking at is a graph that conveys some interesting data.

1. For the last 5 years, the cost to transport a 40′ shipping container (the industry gold standard) almost anywhere in the world has been less than $2,000. Consistently.

2. Since mid-2020, slightly more than a year ago, that cost has increased by 500% to approximately $10,000.

Simple math says that if you were transporting 100 widgets in said 40′ container and you were paying $2,000 per container a year ago your costs looked like this:

100 widgets at $2,000 per 40′ container = $20/widget in shipping cost

100 widgets at $10,000 per 40′ container = $100/widget in shipping cost

Let’s assume these are $1,000 widgets. This means your shipping cost increased by $80/widget which is an increase of 8%.

Doesn’t seem like the end of the world, can’t even see it from there, but it is an inflated cost.

Why did this happen, Big Red Car?

The pundits will give you a list that looks like this:

1. Shipping companies responding to anticipated lower shipping demand took ships out of inventory which drove down capacity which drove up price. [The BRC has a very hard time swallowing this, plus by now this would have been reversed.]

2. It’s the pandemic — see #1 above.

3. That container ship (the “Ever Given”) that got stuck in the Suez Canal — March 2021 — for 6 days. Really? In six days?

4. Consumers stuck at home in their Pandemic PJs went on a buying spree that drove up the volume of shipping that drove up the price of shipping.

It is slightly more complicated.

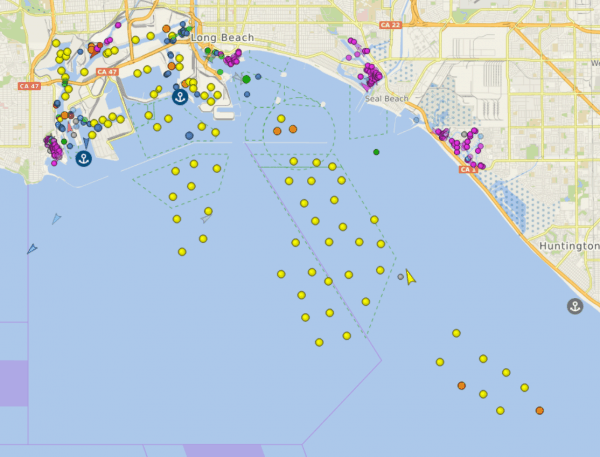

5. Ships arriving to the United States — as an example Long Beach, California — cannot get wharf and dock space to unload. Here is a graphic of a hundred ships waiting at anchor off Long Beach to unload.

6. The unloading dilemma is caused by:

Bigger ships, longer unloading times — contradicts the theory that owners took inventory out of the mix

More ships are needed because Americans are working their credit cards and buying stuff, more stuff, from China

Lack of port unloading labor — labor is unionized and has little ability to surge with increased demand and no desire to work themselves out of a job

Pandemic labor practices — OK, makes a little sense

Trump — not really, but isn’t everything that happens bad for the next few years really Trump’s fault?

As indistinct as the explanations are, the solution is a bloody mystery.

Bottom line it, Big Red Car

Inflation is going to be 10%. OK, I said it. Boom!

A week ago, Sec of the Treasury Janet Yellen said in answer to a question from Senator John Kennedy — the stand up comedian from Louisiana — that inflation would be 4% even though right now it seems to be 8% and accelerating. They were chatting about the debt ceiling.

So, there you have it, dear reader. Inflation is here. It is not 2%. It is not 4%.

Inflation is going to be 10%. Tell me how I have it wrong and tell me why global shipping costs are going to recede.

Fun fact: Year ago average Texas statewide regular gas price was $1.85/gal. I was paying $1.52 at Sams. Today it is $2.85. I paid $2.62 at Sams. Feel like inflation to you?

Calculate that increase — that’s inflation. ($2.62 – $1.52) / $1.52 = 66%.

If global shipping and gas are both up these kind of percentages, where is that “transitory” coming from? Honestly, tell me. Hey, I could be wrong.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car.