In the changing world in which we live, even the most Old School manufacturing companies are finding themselves having to change their ways to find, hire, and retain workers.

John Deere makes farm and construction equipment and its work force is unionized under the United Auto Workers.

Production lines at Deere are hard places to work and it takes a toll on a woman’s/man’s body.

The UAW has had a hard time convincing Deere management to increase wages and the UAW would admit that for the last 20-30 years they had their asses handed to them in every contract negotiation.

Meanwhile, the company has done well with a CEO making $16,000,000, a 160% increase when compared to 2019. This is 220X the average worker at Deere.

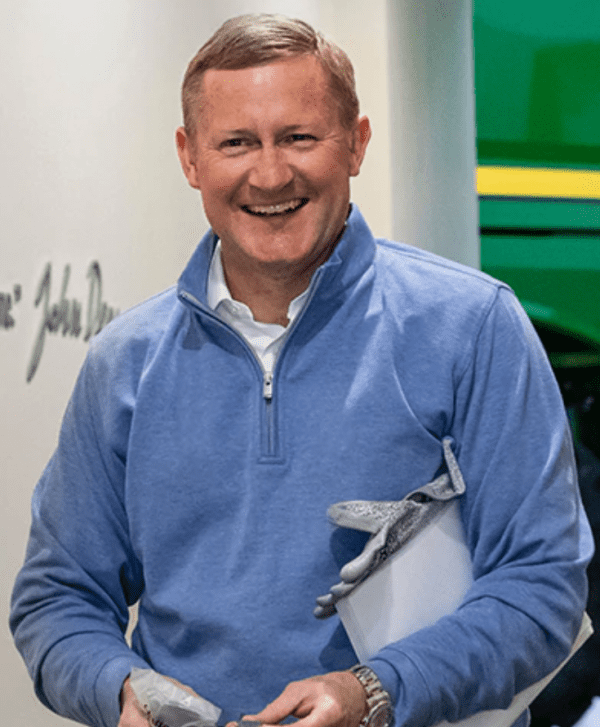

“My name is John May and I’m doing good. I’m the Chairman of the Board of Directors and the CEO of John Deere. Let’s play 36?”

Deere Workers Strike

This time around the contract negotiations were a little different. The union membership rejected the initial offer from Deere management and decided to enforce their rejection by going out on strike.

On strike, a UAW worker gets about $250/week from the union and they join picket lines.

Management made two offers, both rejected, and said they had made their final offer, but that was a head fake and they made a third offer.

The third offer was the charm

The third offer laid out like this:

1. Six year deal,

2. Immediate 10% increase,

3. 5% increase at year 3,

4. 5% increase at year 6,

5. Three 3% lump sum bonuses on 2-year intervals, about $2,500 each based on average wages,

6. An $8,500 signing bonus,

7. Reinstatement of COLA (cost of living adjustments) tracking inflation,

8. An enhanced performance bonus program going from 15% to 20%, and,

9. Enhanced retirement benefits.

The union membership approved this deal by 61% to 39%. Total increase in wages over six years is substantially more than 20%.

Stop — is this inflationary?

John Deere is going OK, more than OK

This is how John Deere’s stock has weathered the Pandemic thus far. None too shabby.

John Deere is not just making a gargantuan spread of construction and ag equipment, it is also slapping the entire operation with better tech:

1. Opening the Fulton Market tech center with 300 tech employees,

2. Deere is buying a majority stake in Kreisel Electric an Austrian company with interesting battery charging infrastructure

3. Analysts are whispering that Deere could be the Tesla of construction/ag — seems a little farfetched to me

A director at Deere makes $140,000 plus six figures in stock options.

The company reported a good quarter:

1. Revenue — 2020 $9.7B v 2021 $11.3B.

2. Earnings — 2020 $2.39B v 2021 $4.12B.

These numbers beat Street estimates handily.

The above was the backdrop for the workers to “get theirs” and they did. Bravo!

Why is Deere doing well, Big Red Car?

Three fundamental things, amigos:

1. Favorable crop prices driven higher by inflation — farmers making more money can buy more toys,

2. Economic growth domestically and internationally, and,

3. Huuuuuuge increases in infrastructure spending — the Build Back Bolshevik Bill tidal wave.

Remember this, all construction and ag equipment manufacturers are cyclical stocks and even you would never take advice on stocks from an ancient, rusty car, right?

Bottom line it, Big Red Car

This is how inflation creeps into the economy. The UAW wage deal — long overdue in my book — is wildly inflationary.

Anybody who tells you inflation is transitory — tell them the John Deere – UAW agreement is for six years.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car and I’m going on strike!