Big Red Car here on a lovely, sunny Texas day, y’all. Hope it is going well for you and yours.

I always like to take a peek at what Warren Buffet owns as it relates to stocks. It is often an eye opener. It is often pretty damn plain vanilla and boring, but something caught my eye.

Buffett famously has eschewed investing in technology suggesting that there is a limited longevity and defensibility of the competitive advantage for tech based companies and that it is very difficult to identify the big winners at a time when their stock price is reasonable. This was his view back in 1999 when Forbes interviewed him for an excellent article. Take a second and consider that statement. This from a guy who has to deploy $200B in stocks.

“My name is Warren Buffett. I’m 84 and I’ve been at this investing business for a long time. Don’t be blowing smoke up my ass about bitcoin and cryptocurrency. I was in business when the US was on the God damn gold standard.”

He and noted venture capitalist Marc Andreesson had a pithy exchange about the future of bitcoin. When Buffett called it a “mirage” Andreeson countered that Buffett “…was just an old white guy crapping on a technology he didn’t understand.” [I see no reason why Buffett’s ethnicity was germane to the discussion, do you?]

Buffet has long been quoted as saying, “All you people piling into dot-com stocks must be much smarter than I am, because I just don’t get it.”

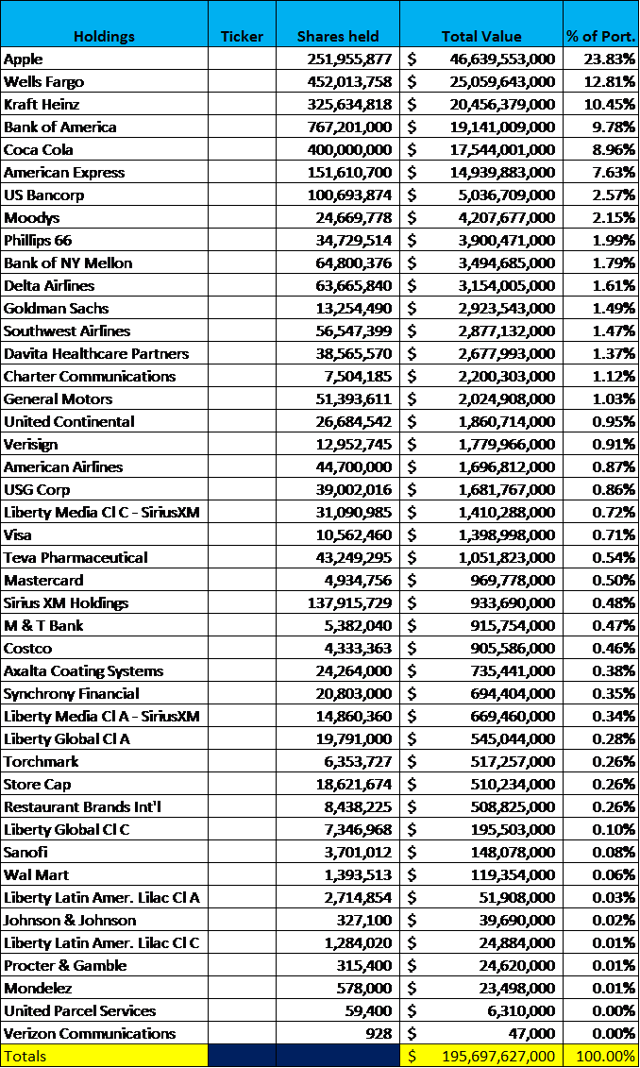

So, you can imagine my surprise when I found out that Apple is Berkshire Hathaway’s largest stock holding by value at 23.83% of his portfolio of 44 stocks.

OK, I want to know why Warren Buffett and Berkshire Hathaway own 928 shares of Verizon Communications? Maybe he should give it to his secretary?

So, there you have it, dear reader. The Wizard of Omaha, who is not a tech investor, has as his largest holding Apple Corporation.

But, hey, what the Hell do I really know anyway? I’m just a Big Red Car. Be good to yourself cause nobody else wants the damn job.![]()