The US government, the Biden admin, has already passed one huge Pandemic-related bill earlier this year and is in the death throes of passing two more:

1. The American Recovery Plan Act was passed by the Dems to the tune of $1,900,000,000,000.

2. The Infrastructure Investment and Jobs Act is waiting passage to the tune of $1,200,000,000,000.

3. The Build Back Better Bill (The Bernie Sanders, “Damn Right I’m A Socialist” Bill) is awaiting passage to the tune of $3,500,000,000,000, but has been sent to the gym and whittled down to $1,900,000,000,000.

This is a “nominal” total of $5,000,000,000,000 ($1.9T + $1.2T + $1.9T = $5,000,000,000,000), but it will actually be far more — at least 2X — than that nominal amount because of the bogus way Congress prices such bills.

See:

The Black Magic of Congressional Arithmetic

for an explanation of how Congressional arithmetic really works.

Can we get some damn perspective, Big Red Car?

To put that into perspective:

1. US federal budget FY 2020 – $4,790,000,000,000, blown up to deal with COVID.

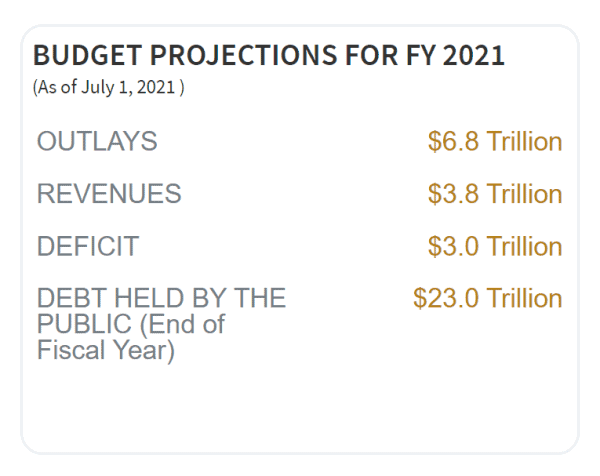

US Federal budget FY 2021 – $6,800,000,000,000. Huge increase.

2. US Federal Tax Revenue — personal income taxes, payroll taxes, corporate income taxes, excise taxes, Federal Reserve earnings — in FY 2021 will be $3,863,000,000,000.

This is record high revenue.

3. We are looking at a three trillion dollar deficit which will be added to the National Debt of $30,000,000,000,000. This number comes from the Congressional Budget Office and doesn’t include some of the above spending.

4. This new spending program will be approximately a third of the National Debt — a slight over simplification, but it makes the point which is this: We are going on an orgy of government spending, a Jabba the Hutt splurge of historic proportions which is going to have some earth shattering impacts.

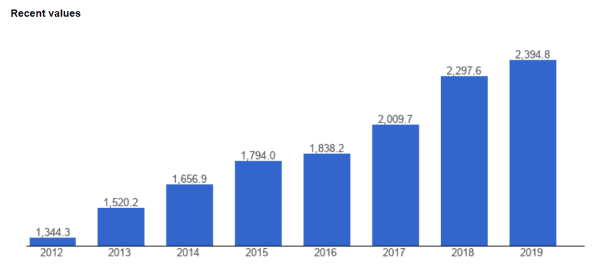

5. To put this spending into perspective, our adversaries in the world — China and Russia — don’t spend nearly as much. China, while being a country of 1,400,000,000 people versus US population of 330,000,000, looks like this:

So what, Big Red Car?

Haha, here’s what, dear reader.

1. These three bills are massive in their sheer magnitude and are the largest spending program in the history of the United States coupled with the largest tax increase in US history.

Consider that for a moment, ponder it — is today the right time to do this?

2. When the government takes money from the economy in the form of taxes, it costs approximately $0.26/USD to collect it. Tax revenue immediately diminishes the economic vigor of dollars.

3. Government spending has a negative multiplier effect.

4. Private spending has a 3.5X multiplier effect.

5. Huge government programs are all based on a simple construct: “We, the bloated Federal government, know better what to do with your money than you do. We will take your money, watch it shrink in the collection process, and send it back to you, because we know better. Say thank you. Oh, yeah, we will fund some weird stuff, welcome to partisan politics and the feeding trough.”

Inflation, Big Red Car?

Yes, dear reader, we are in the midst of an inflationary spiral.

Even the lying Sec of Treas Janet Yellen, she of the official 2% target, the lying prediction that inflation will be 4% (recent Senate testimony), the acknowledged 5.4% CPI increase, the acknowledged 8.6% PPI increase, and the prediction that inflation will be with us through the end of Cy 2022 at the very least admits “Houston, we have a problem.”

“OK, so I was a little off on that inflation thing. So what? Bite me. I finally admitted we’re going to see inflation for a couple of years. Transitory?” Not so much.

A word about CPI – the Consumer Price Index – which is the increase in prices experienced by all of us. The big driver is energy costs which are admitted to be up by 25% and which most folks think are up by 3-4X that amount.

The word? It is bloody pervasive. Everything is going up because everything is held hostage to energy.

A word about the PPI – the Producer Price Index – which is the increase in the price of finished goods at the manufacturer’s shipping dock.

The word? It is predictive. If the finished goods prices are increasing at a higher rate than consumer prices, and it takes some time to get from the shipping dock to the store shelf — what is going to happen?

More price increases are waiting for us. Merry Christmas, Mrs. Inflation.

Growth, Big Red Car?

A word about growth as measured by Gross Domestic Product.

What is that word? Growth is slowing. This last quarter – Q3-CY2021 – it was 2%.

The Atlanta Fed which publishes a weekly forecast of GDP growth pegs it at 0.5% for the next quarter.

Inflation + Slow Growth = Stagflation

If you are seasoned enough to have been alive during the Carter admin, then you are familiar with the term “stagflation.”

If not, listen up.

When you couple inflation with slow growth you get a state of affairs that is stagnant.

Why is this important? Because there are only two ways to get out of an inflationary spiral — grow your way into the new prices or endure pain, real pain.

At the end of the Carter admin, the Prime Rate was 20.5%. We had inflation, slow to no growth, and exorbitant interest rates. It was very painful and it took a decade to work our way free of that malaise.

Bottom line it, Big Red Car, you’re making me nauseous

Sorry. Let me leave this with you.

1. We are launching into an orgy of spending, more than in the history of the United States. Does anybody think allowing the government to spend $5T (likely $10T) can possibly be anything but inflationary?

2. We are already being slapped around with rising prices everywhere. Everywhere.

CPI is up more than 5% — target 2%.

PPI is up more than 8%.

3. We went from being energy independent to returning to an energy vassal state begging the Saudis to open the tap. After 70 years, we were so over that.

That one price point — crude >>> gasoline — led the inflationary spiral.

It was a self-inflicted wound. [Don’t worry. Joe Biden feels your pain even more since he caused it. Can’t you feel the empathy? Good old Joe, a scrappy kid from Scranton who has never had his lips off the government teat in his life. Never had a real job. Scrappy old Joe will figure it out.]

4. Growth has begun to slow in a meaningful way. It was 2% last quarter and the Atlanta Fed is whispering it will be 0.5% next quarter. [Your Big Red Car thinks it will be a negative number. Yep, heard it right here. We will see a contraction in GDP next quarter.]

5. We are enacting the largest tax increase in the history of the United States. Can this possibly be good for the country at this time?

Inflation + slow growth + gigantic spending + record tax increase = DISASTER.

Cherry on top, y’all?

I predict that we will lose control, absolute total loss of control, of inflation and we will see double digit inflation within six months.

Can you say hyperinflation?

We have seen this movie before — Jimmy Carter — and believe me it has a nasty denouement.

Let’s reason together and avoid this DISASTER. Shall we?