Big Red Car here. Beauty of a day here in the ATX. What a day. Hope you get some convertible time for your good old self, Old Sport.

You deserve it and that convertible damn sure does.

So The Boss was talking to a couple of budding entrepreneurs and they were chatting about from whence the money comes to fund and build a new company — a startup business. They were also looking at buying a small business as an alternative. In any event, the issue was money. Money for funding a startup or small business.

For a lot of ya’ll this is going to be Ned in the Third Grade, so bear with it but be nice. You can be nice, right?

Money is a commodity, fuel really

Money is a commodity and it is the fuel that drives a new business. No money, no business.

There are multiple sources of funding for a new or startup business.

Logical ones are as follows:

1. The founders themselves — savings, credit cards, collateralized loans;

2. Friends and family;

3. Angel investors, high net worth individuals;

4. Grants, pools of government money;

5. Venture capitalists, hedge funds, private equity funds; and,

6. Financial institutions.

There may be others but these are the logical suspects. The role of hedge funds and private equity funds is very limited but worth mentioning as they blur the lines and wander into the traditional venture capital arena. Government money and grants are out there but we shall overlook them for the purposes of this discussion as they are a bit non-traditional.

What is being funded

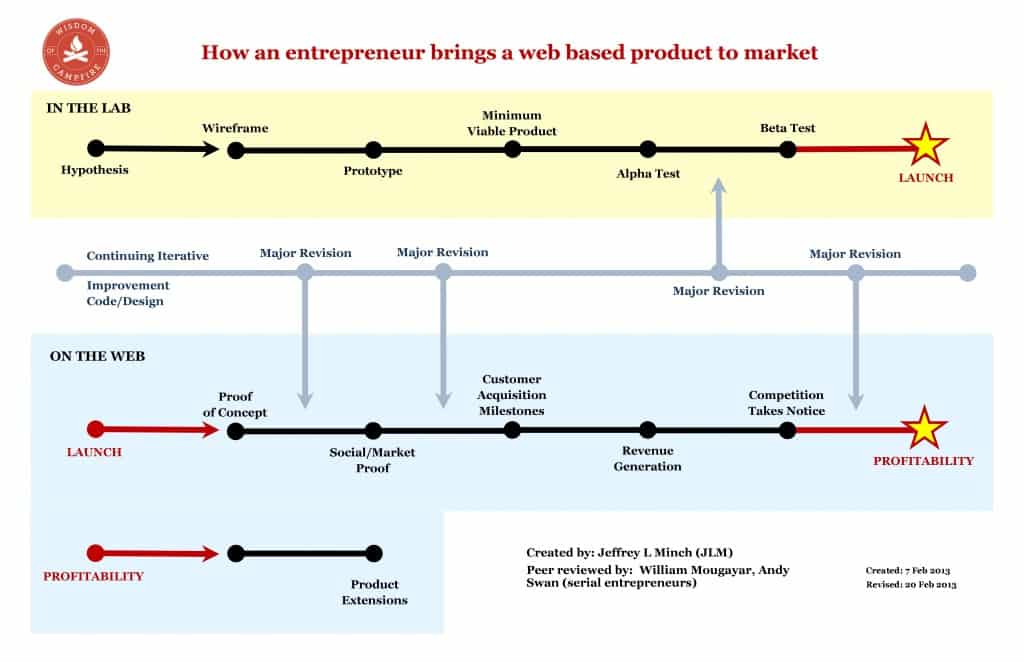

You are funding an idea initially — just a business hypothesis. No real substance, just a flight of fancy.

Then that business takes root and becomes some plans on paper and the product, service or company takes a bit of shape. A clearer vision perhaps.

Then the business begins to take on a bit more definition and in the case of a web based business perhaps a wire diagram of the web presence begins to take root.

The product is developed into a working prototype perhaps the mythical Minimum Viable Product.

Then it is tested a bit and unleashed onto an unsuspecting public.

Then it gets a bit of traction and perhaps a validation from the marketplace in the sense of a product-market fit and then on to profitability.

It could all look a bit like this. Click on the graphic to see it at a more useful scale.

This is a bit of a simplification and there will be more than a bit of wailing and gnashing of teeth before your new enterprise is profitable and you are pricing yachts. But one can dream, no?

Phases of funding

The funding process also is equally predictable and well organized. This is just a discussion and there are many different ways to describe the phases and to subdivide the pie but this is a useful framework to organize that discussion.

It follows a continuum similar to this:

Bootstrapping — self funding by the founders;

Friends and family — your retired uncle who sold his business and lives in Florida who funds his favorite niece or nephew;

Angel investors — successful entrepreneurs or high net worth individuals who invest with some discipline and orderliness;

Seed funding — angel investors; specialized venture capital firms — a specialized risk profile of venture firms who invest OPM at an early stage of development;

Series A, B, C, D — venture capital firms of increasing size — progressively larger investments and firms who invest OPM at growth phases of the enterprise; and,

Initial Public Offering or strategic sale or liquidity event — public markets, strategic acquirers who write big checks to own the enterprise.

The lines may become a bit blurred particularly during the early phases when the founders are just scrambling for money to make their idea into a reality. The Big Red Car has also grossly over simplified many of these distinctions but you get the idea, Old Sport.

It can be a very organized and orderly process with founders, funders and the company evolving during the process of transforming the original hypothesis and vision into a growing reality.

Here is a very useful infographic which sheds a bit of light on this subject also. Click on it to see it full size.

The funding of startups and small businesses is a dynamic but fairly orderly environment. Things are constantly changing but it is useful to know the players, understand their motivations and appetite for risk and to identify the benchmarks for phased growth along the journey.

But, hey, what the Hell do I know anyway? I’m just a Big Red Car.