Do y’all recall when inflation was “transitory?” When the Secretary of the Treasury and the POTUS used to assure us that inflation was going to come and go? That the target would continue to be 2% – which, in fact, it had been?

Well it’s more than a year later and, clearly, that is not going to happen. In fact, we are in this inflationary spiral for the long term — meaning three years until there is any relief.

How did we get here, Big Red Car?

Let’s review the bidding to see how we got here, shall we?

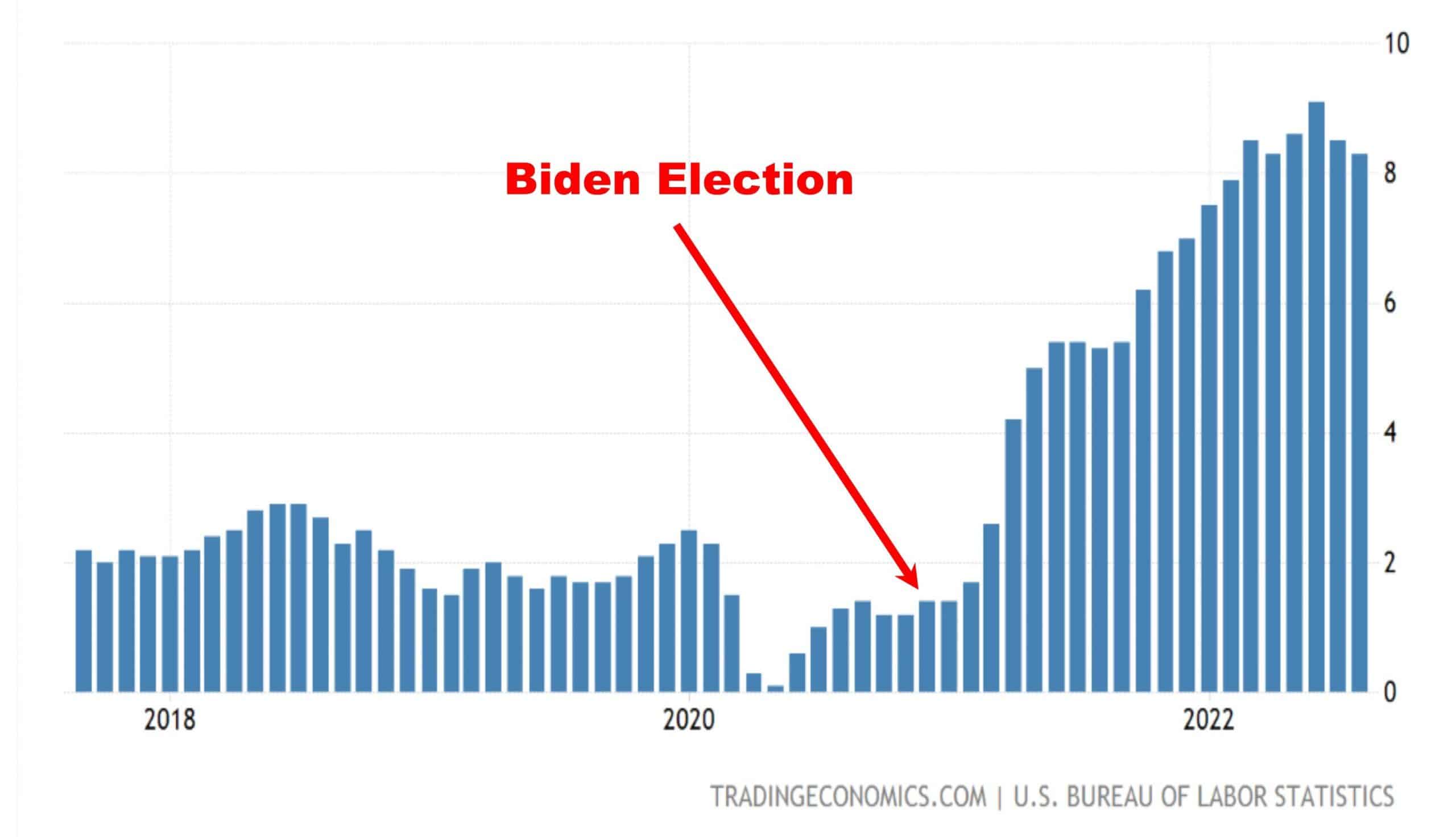

This chart is not lying to you. Study it.

During the first week of the Biden admin, the POTUS via executive order cancelled the Keystone XL pipeline and took other Draconian measures that began the War on Energy.

It started right here and that was a death blow delivered with glee.

So, what happened then, Big Red Car?

As the price of gasoline skyrocketed, the cost of everything with any component of transportation began to rise which was then compounded by a supply chain crisis – not originally of the admin’s doing.

Here we sit today with the highest inflation since the Carter years in the early 1980s when an Iran oil embargo drove inflation to 14.6% (April, March 1980) and the Prime Rate to 20.5% and harelipped the economy big time.

We have seen this movie before.

How do you cure inflation, Big Red Car?

It is like chemo, dear reader. It is painful.

Back in the Carter era, Paul Volcker was the head of the Fed and drove interest rates to 20.5%. We used to track the Prime Rate in those days, not so so much today.

Paul used to say, paraphrasing the old boy, “You have to drive interest rates to 1.5X the rate of inflation to combat it effectively.” This effectively kills spending and with no buying pressure, the rate of inflation subsides begrudgingly.

1. Current inflation is more than 8%.

2. This would suggest we are looking at 12% interest rates for starters according to the Volcker Rule.

We know this, but nobody is telling you. This is the solution.

Embedded?

Yes, dear reader, when inflation is finally licked – which will take at least three years to do — it will not lower prices in its wake. The prices — the embedded inflation — stay high whilst the rate of inflation subsides.

Look at the above graph and recognize why it will take three years for the rate of inflation to subside. We know this and always have.

Bottom line it, Big Red Car

OK, dear reader, here it is:

1. Inflation is at a 40-year high at more than 8%.

2. The Federal Reserve has already begun to raise interest rates substantially, but they are not anyway near finished. They will go to 12%, but they won’t tell you right now.

3. Think this is a head fake? Take a look at the 30-year mortgage rate in the last year. It has bloody doubled which will crush hopes and dreams as well as homebuilding, a critical American industry, a bellwether industry.

This is the real world nobody is talking about.

4. Interest rates are going to 12% and money is going to dry up until inflation is beaten.

5. The current energy policy of this administration is the largest and most powerful manageable variable of this battle and they are making it far worse.

6. Hey, we know all this stuff, but nobody is telling you the truth. We have seen this movie before.

Have a great weekend. Call somebody or visit somebody who would love to see you.

God bless you and God bless America. God bless Joe Biden and give him the inspiration to do what needs to be done.