Big Red Car here.

Nice weather in the ATX and I am thinking I might just get a chance to hit the road today.

The Boss has already taken my top down but that may be just to dry me out a bit. We shall see. Cold here.

The Boss was up early and had some breakfast tacos. He is always in a good mood after breakfast tacos. But not today. Today The Boss watched the President’s press conference and was struck by how out of touch Washington is with basic financial management and expertise.

Budgeting

The Boss says that budgeting is a very simple process.

1. You figure out how much money you have coming in — REVENUE — over some period of time, typically a fiscal year.

2. You figure out how much money you want to spend — SPENDING — over the same period of time.

If your revenue exceeds your spending, then you have a surplus. You can save that surplus for a rainy day.

If your spending exceeds your revenue, then you have a deficit.

You will have to fund this deficit by dipping into your savings or by borrowing the money from some third party.

The United States has no savings, so the deficit has to be funded through borrowings driving up the National Debt.

Look at the National Debt on the upper right corner of this website.

Uh oh, we really have some debt, Lucy. You got some ‘splaining to do, Lucy.

Legal Requirements

By law, the President is supposed to deliver a budget for the United States to the House of Representatives no later than the first Monday in February.

For the last four years (including this year), the Administration has broken this law by failing to submit ANYTHING — budget or otherwise.

In a letter to Congressman Paul Ryan, the Chair of the House Budget Committee, the Administration confirmed that it will again break the law and will not submit a budget.

Check out the link for a bit more information.

The President is arguably sticking his thumb in Congress’s eye.

Debt Ceiling Negotiations

While this abrogation of basic legal responsibilities is going on, the Nation has run up against the authorized debt ceiling — the credit card limit on the Nation’s credit card.

This credit card limit can only be increased with the approval of Congress. Remember all spending bills must originate in the House of Representatives. Founding Fathers — checks and balances thingy.

This is neither new nor novel. It has been going on for years. Every President has had to deal with it.

In the past, every President who has desired an increase in the debt ceiling has had to negotiate with Congress and agree to certain spending modifications in order to get an increased credit limit.

Just for the record, President Eisenhower balanced eight straight budgets while building our nuclear arsenal, initiating the Interstate Highway system and playing a lot of golf. The reality is that recent Presidents could not hold DDE’s jock when it comes to financial management success or skills.

The entire Fiscal Cliff head fake was the result of the last round of debt ceiling negotiations in which the Administration and Congress agreed to increase the debt ceiling while forming the now infamous “do nothing” Super Committee whose failure to reduce spending, as agreed, resulted in the imposition of sequestration.

Sequestration, the President’s inspiration, is the involuntary imposition of spending cuts totaling approximately $110B in Defense and non-Defense spending.

Here is what then Senator Obama thought of the debt ceiling negotiations when George Bush was the President.

If you follow that link you will see that then Senator Obama thought increasing the debt ceiling was “unpatriotic”. Obviously his thinking has evolved just a bit since becoming President.

Squandered Time, Treasure and Irresponsibility

The government at all levels is irresponsibly squandering time and treasure while it dawdles and fails to face the fundamental problem with our economy — spending is out of control and has to be curtailed and slashed.

It has to be done and it is not getting done.

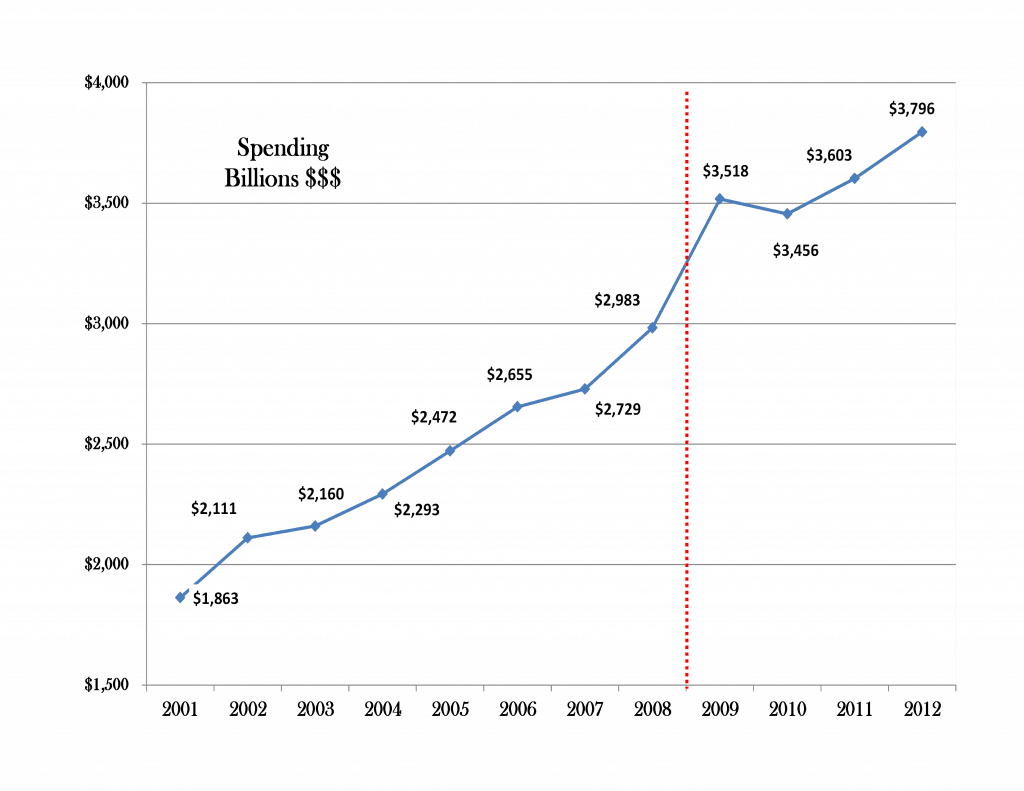

Look at this simple graph and tell me whether you can see the spending problem clearly.

You cannot eat four cheeseburgers at every meal and expect not to have serious health problems. Can you?

Tell me what you would do to get Congress and the Administration to stop squandering time and treasure and to act responsibly.

But, hey, what the Hell do I know anyway? I’m just a Big Red Car.

A friend recently told me that the spending crisis becomes very understandable if you remove a few zeros. It becomes a familiar to almost anyone who has to manage living within a budget!

.

I agree completely. The other thing is to think about it like a credit card.

Your spouse wants to solve the problem by getting a higher limit on her Amex card.

.

Or via the “saving fallacy”. Look I bought this on sale for $60 when it was worth $100. Saved $40 or spent $60?

Politicians deceive us the same way when they say they are saving $x and $y when they are really spending $z and making the hole deeper.

.

Depends on whether you are married or dating, no?

.

That aside, point is that it’s not a “real saving”. I was thinking of the government saying they are saving this or that while they are actually still spending.